4.5.24 Weekly Recap

Weekly Action:

Corn May24 down 8.5c at $4.33 3/4

Beans May24 down 5c at $11.87

KC Wheat May24 down 3c at $5.84

Hogs April24 up 2.6 at $89.325

Fats April24 down 6.85 at $178.375

Feeders April24 down 8.975 at $238.225

Corn Dec24 down 6c at $4.72

Beans Nov24 down 1c at $11.86

KC Wheat Jul24 down 1c at $5.80

Market Recap:

*April WASDE Thursday April 11

Market reaction was initially supportive for corn Thursday on prospective plantings, but saw retracement early in the week on good planting weather forecasts. We have since inched higher in corn back to slight technical resistance levels and areas at last market strength prior to the report.

Over the last 10 years, the U.S. has set a new record for corn yield. The main outlier was 2019 when yield was -2.4% trend.

Bean exports were down from January and February figures and lower over the last week despite a nice sale announced to Mexico. FAO-AMIS estimated world bean stocks at 49.5 mil tonnes up from 48.7 mil last month.

Global food prices were also reported higher in March by 1.1% over February.

Speaking of food, if you haven’t been to the store and noticed higher prices for your favorite chocolate bar, note that Cocoa made an all time high Tuesday at $10,324/ton. It has since had two consecutive days of strong liquidation on major cocoa producing nations raising prices paid to farmers by nearly 50% in hopes to bring more beans to market.

Feeder Cattle have seen a downtrend recently that was exacerbated this week due to the avian flu. Cases have been reported in dairy cattle but not in beef cattle yet. Meat and Milk supply are fine at this point; however, some are wondering if the increase in cases will result in limitations of animal movement.

On to spring planting information as the topic will dominate headlines for the next few weeks:

Corn planting is 2% done which is the same as last year and better than the five year average of 1%.

There will be a small percentage of beans planted prior to corn as a trend over the years in parts of northern Missouri, Nebraska, and Iowa.

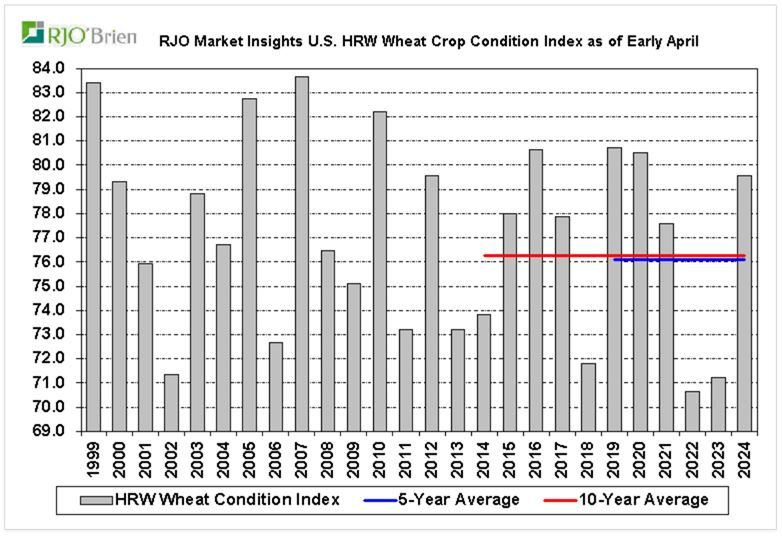

Early April U.S. HRW ratings are the best in four years. Overall winter wheat ratings are 56% good/excellent compared to 28% this time last year. This could come at a great time for US producers as Russia recently announced plans to curb wheat exports.

Weather:

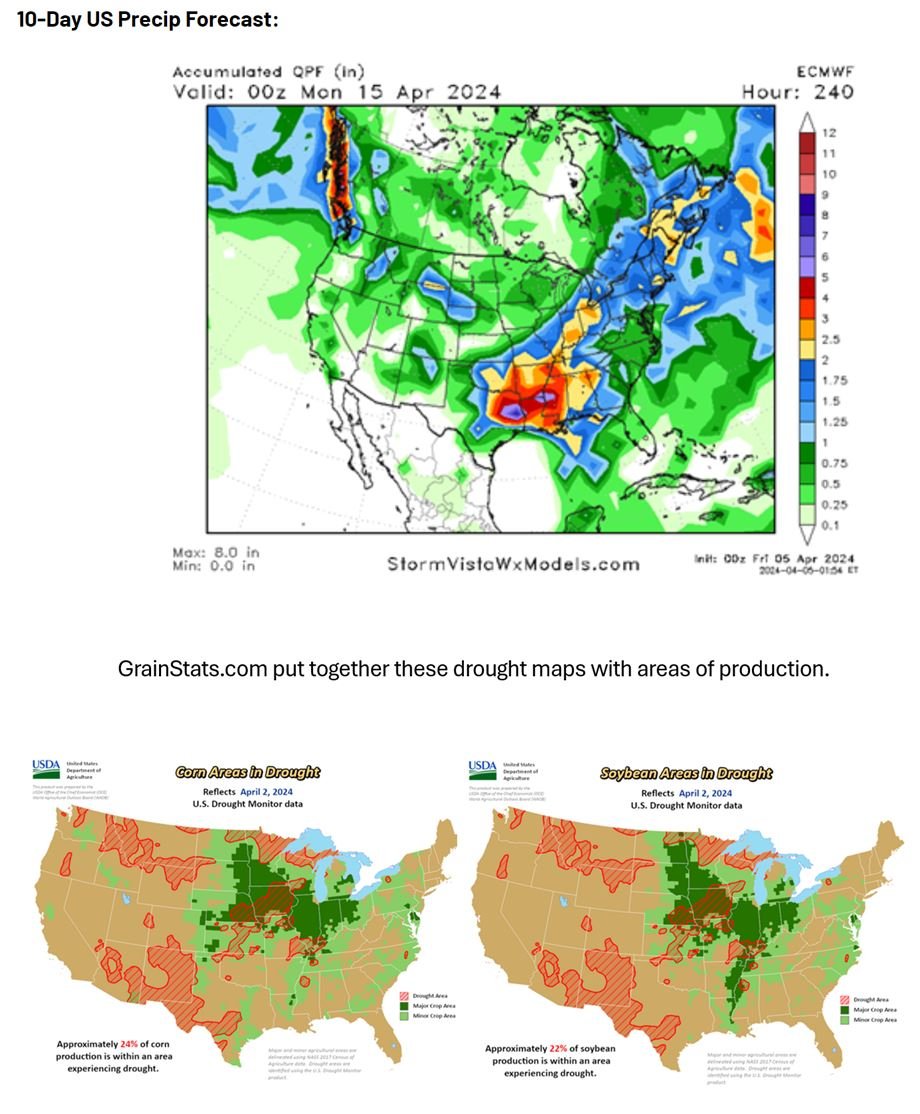

Soaking rains are expected in the Delta/Southeast. If realized it could delay spring seeding into late April. Recent rains in Iowa were helpful; and more forecasted this weekend. However, the majority of the state still remains in significant drought category as seen below.

Economy:

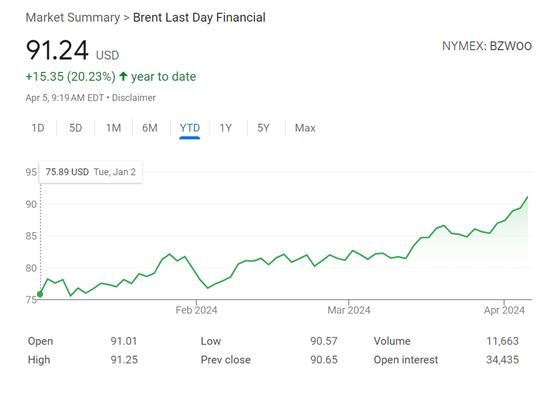

The oil market has rallied with the recent tension escalation in the Middle East. Oil is now around $90/barrel, which is about a 20% increase since the beginning of the year. The market fears retaliation from Iran after Israel attacked their embassy, killing a high-ranking Iranian General.

OPEC+ also stated they will stick with recent planned supply cuts (-2 million barrels/day). Mexico recently announced they are curbing exports. The US has also announced plans to cancel oil purchases for the Strategic Reserve that were announced in Mid March for a site in Louisiana citing increased prices.

Gold is also making news. It’s up over 25% in the last six months as investors are spinning out of all-time highs in the stock market and anticipating Fed rate cuts yet this year.

Jobs data fresh this morning is very promising: Payrolls added 303k jobs exceeding all projections and dropping unemployment to 3.8%. The March addition over February for jobs is the best since May 2023.

Americans spent $113 billion on lottery tickets last year. This is more than was spent on movies, books, concerts, and sports tickets COMBINED.

The 30-year fixed rate mortgage is now an average of 6.82%. If you bought a $400,000 house (20% down) meaning you borrowed $320,000 your monthly payment over 30 years was: $1,436.

To get the same $1,436 monthly payment at today’s rate: you could only borrow $220,000.

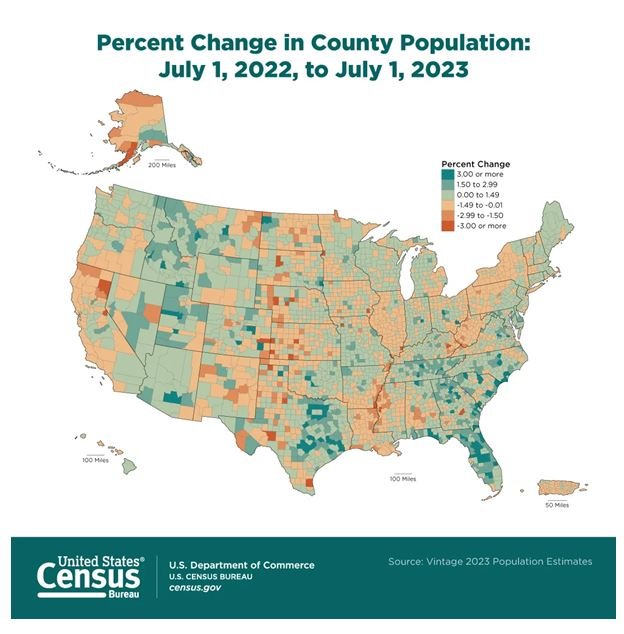

In discussing the housing market; trends on where American’s move is interesting to note… below the graphic of net county movement July 2022 to July 2023.

Something That Probably Means Nothing:

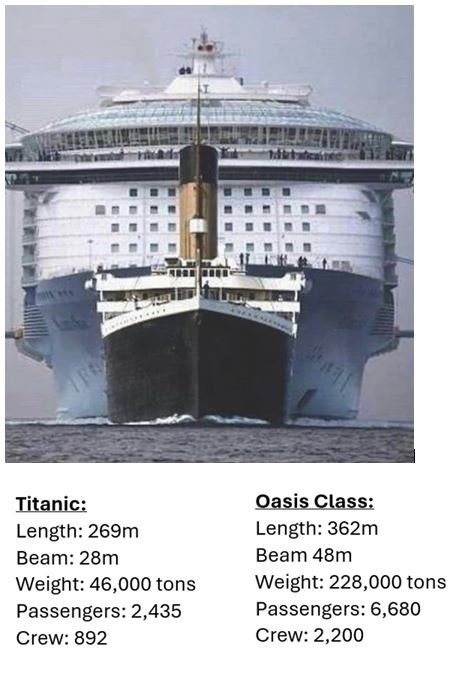

The Titanic compared to a modern Oasis Class cruise ship:

Quote of the Week:

“No winter lasts forever; no spring skips its turn.” – Hal Borland