Tredas Weekly Recap 2.2.24

Weekly Action:

Corn Mar24 down 3 at $4.43

Beans Mar24 down 23 at $11.88

KC Wheat Mar24 up 1 at $6.27

Hogs April24 up 1.10 at $83.775

Fats April24 up 2.55 at $183.925

Feeders Mar24 up 5.45 at $245.20

Corn Dec24 up 1 at $4.77

Beans Nov24 down 15 at $11.71

KC Wheat Jul24 down 5 at $6.18

New Crop Corn/Bean Ratio: 2.45

Market Recap:

This week, the USDA reported the US beef herd is down to 28.2 million head, which is down 2% from last year and the lowest herd size since 1970s.

Local corn basis has softened anywhere from 5-10 cents for February/March as the cold snap is over and trucks are moving again.

Thursday’s USDA Oilseeds Crushings report showed 204.1 million bushels of soybeans were crushed in December. Although slightly below expectations, this is a new all-time record. It’s a 9% increase from last December. Current export commitments are 1.4 billion bushels, which is nearly 20% below last year's levels. USDAs projection of 1.732 billion bushels is 12% below last year.

Total corn export commitments are currently 1.326 billion bushels. This is 63% of USDAs 2.1 billion bushels estimate for the crop year. The 5-year average for this time of year is 65.6%. To reach the 2.1 billion bushel estimate, weekly export sales need to average 22.5 million bushels through August. Through the first 21 weeks of the marketing year, US weekly ethanol production is up 4.7% compared to a year ago. USDA is projecting ethanal use of 5.375 billion bushels which would a 3.8% increase from last year.

The February WASDE will be February 8th next week.

Weather:

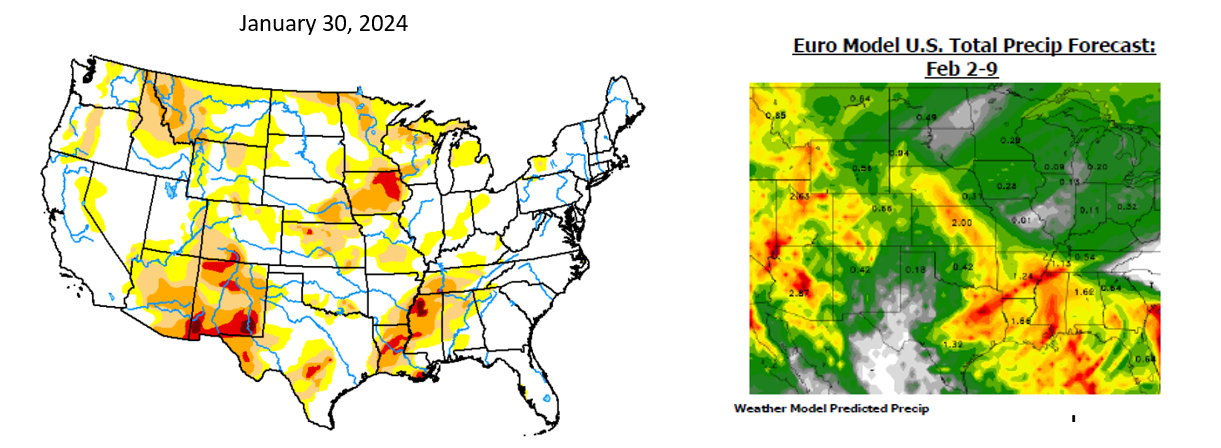

It is now February and believe it or not your will start hearing news of corn planting in southern Texas. The US forecast is showing upcoming precipitation in the Delta area. If realized, this could go a long way towards restoring Mississippi River levels. Eastern Iowa is currently a concern as far as soil moisture is concerned.

Economy:

The odds of a Fed rate cut in March moved under 20% after the stronger than expected employment report. Only a month ago the market was predicting a 70% chance of a rate cut.

The US unemployment rate has been below 4% for 24 straight months, which is the longest streak since the late 1960s.

The Magnificent 7 (Tesla, Meta, Alphabet, Amazon, Apple, Microsoft, and Nvidia) now have a larger market cap than any other country’s entire stock market.

Something That Probably Means Nothing:

The average price of a Super Bowl ticket is a record $9,815. This is a 70% increase from just last year and 40% above the previous record from 2021.

Quote of the Week:

The year is already 1/12th (8.3%) over.

“Time is what we want most, but what we use worst.” – William Penn