4.26.24 Tredas Weekly Recap

Weekly Action:

Corn July24 up 8 at $4.450

Beans July24 up 14 at $11.77

Hogs June24 down .625 at $105.875

Fats June24 up 2.925 at $178.625

Feeders Aug24 up 6.75 at $260.175

Corn Dec24 up 7 at $4.73

Beans Nov24 up 13 at $11.74

KC Wheat Jul24 up 70(!) at $6.54

Corn seasonal average (57% through): $4.69 (something to think about: if you are making decisions above the average, you are beating the average)

Market Recap:

The news of the week was in the wheat market. KC wheat finished the week up 70 cents and is up $1.10 since making its contract low March 6. This on continued dryness in Southwest Kansas and the Oklahoma/Texas Panhandle which obviously produces a large amount of HRW. Technically speaking it was also a week that may have scared some of the market shorts. July wheat broke the 100 day and 200 day moving averages which should trigger high frequency computers to cover their shorts. Be mindful though, late April-mid May has historically been a productive time to make catch up sales going into harvest.

Commitment of Traders data reflect this. The information below is as of Tuesday, so likely does not tell the whole story of managed money action in the wheat market from Wednesday-Friday. Managed money also had large buy weeks in corn and soybeans, but the Producer/Merchant weekly change largely offset this. This would indicate a lot of famer selling/pricing as May futures are set to come off the board.

Both old and new crop corn trade has been boring for both bulls and bears the past two months. The market is stuck in a 15-20 cent range. The 100-day moving average has acted as an unbreakable ceiling. Corn contracts closed right at these averages Friday. Next week we will find out if the act continues or if we can push through.

Soybeans finally showed some life this week and closed right below their 100-day average.

Weather:

If you’re ever curious about rainfall totals around the state of Nebraska, this website is super handy: https://nednr.nebraska.gov/NeRain/Maps/maps

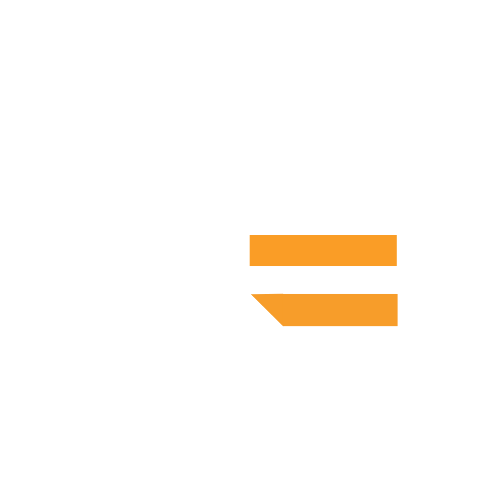

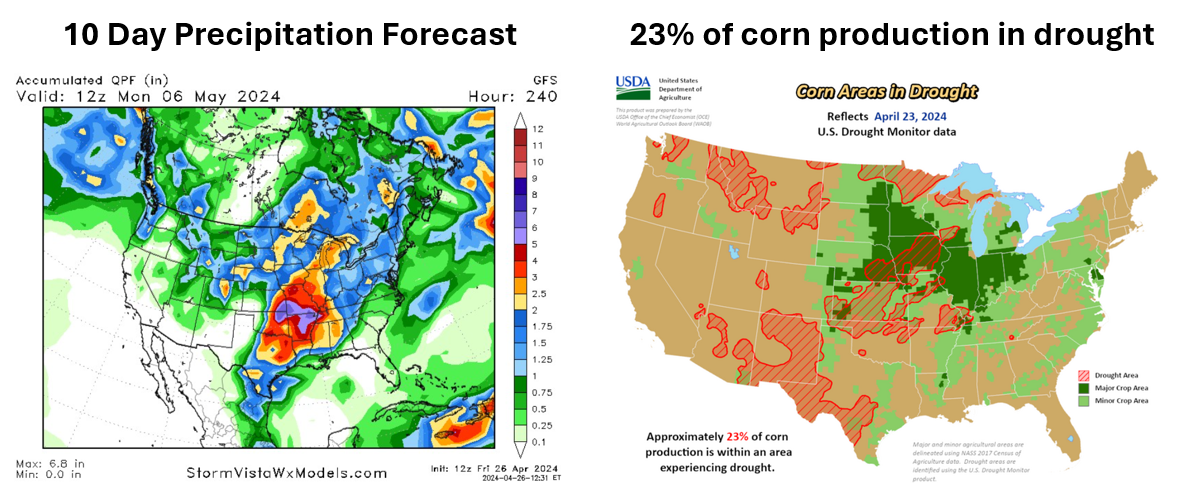

The 10-day forecast provides some good rains in the delta region and the upper central corn belt but leaves a widespread area of continued dryness in Southwest Kansas and the Oklahoma/Texas Panhandle region.

According to the National Oceanic Atmospheric Administration (NOAA), there’s now a 60% chance La Nina will develop between June and August. If realized, it would most likely mean above average heat in the west and south and dryness in the south.

Economy:

U.S. GDP for Q1 was released this week. Growth slowed to 1.6% which is less than half the growth from just Q4 2023 and 50% below a lot of professional expectations. Core PCE Price Index soared from 2.% to 3.4% suggesting inflation is on the rise. In summary, our economy is shrinking while inflation is growing. This puts the FED in a terrible position: do they cut rates to stimulate the economy or do they raise rates to curb inflation?

Tesla reported a 9% drop in revenues this week resulting in a 55% reduction in net income. This is the biggest year over year decline since 2012.

“You have to be wildly optimistic to believe that corporate profits as a percent of GDP can, for any sustained period, hold much above 6%.” – Warren Buffett, 1999

Quote of the Week:

“Try to approach the situation with the attitude of a calm, domesticated hog instead of that of a wild, truffle hungry boar.” – my chemistry TA

Enjoy your weekend!