2.9.24 Tredas Weekly Recap

Weekly Action:

Corn Mar24 down 13.5 at $4.305

Beans Mar24 down 3.25 at $11.8475

KC Wheat Mar24 down 24.75 at $6.0225

Hogs April24 down 2.625 at $81.150

Fats April24 down 2.8 at $186.725

Feeders Mar24 up 1.95 at $247.150

Corn Dec24 down 8.75 at $4.6825

Beans Nov24 down 6.75 at $11.6425

KC Wheat Jul24 down 23 at $5.9525

New Crop Corn/Bean Ratio: 2.48

Market Recap:

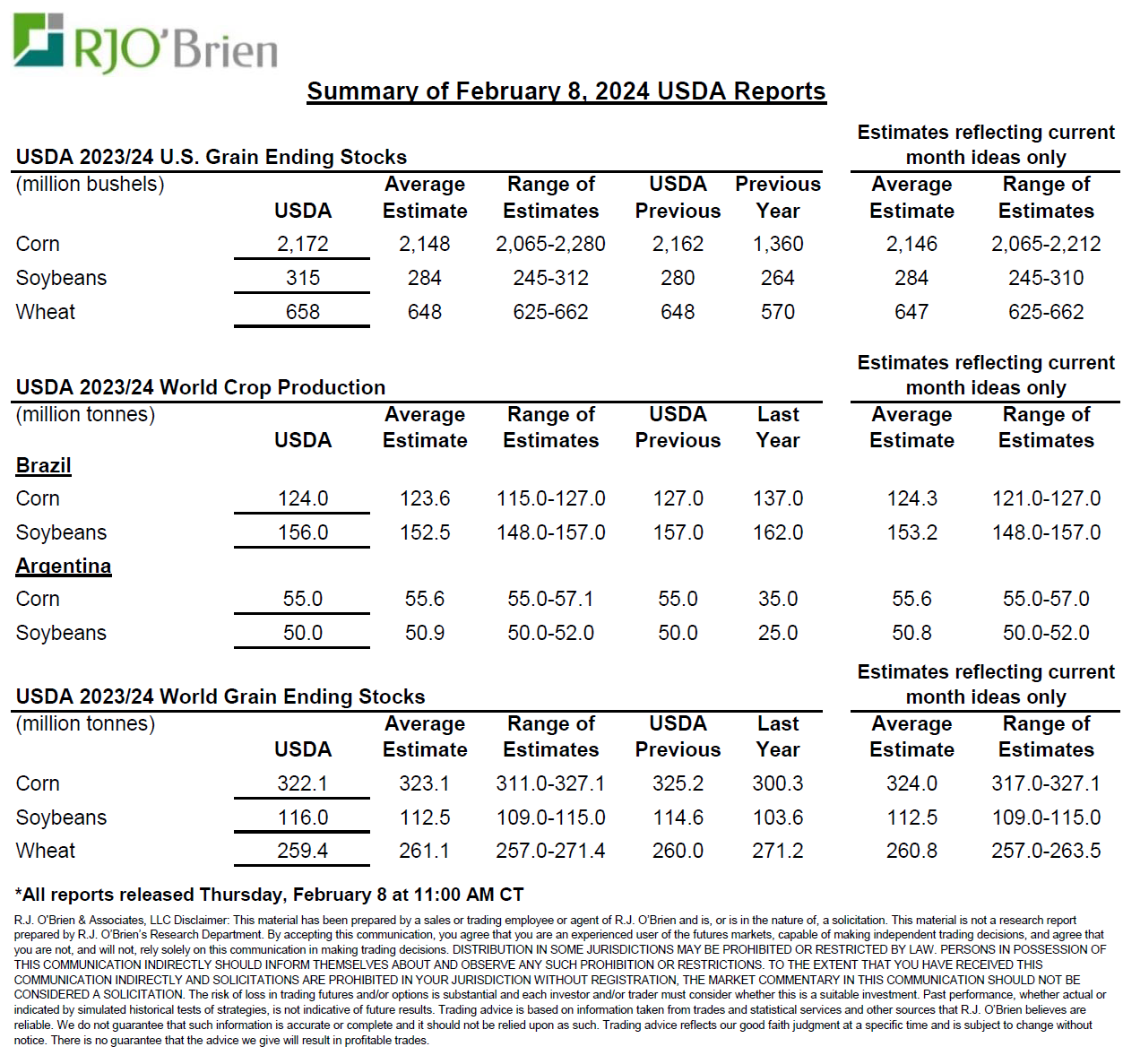

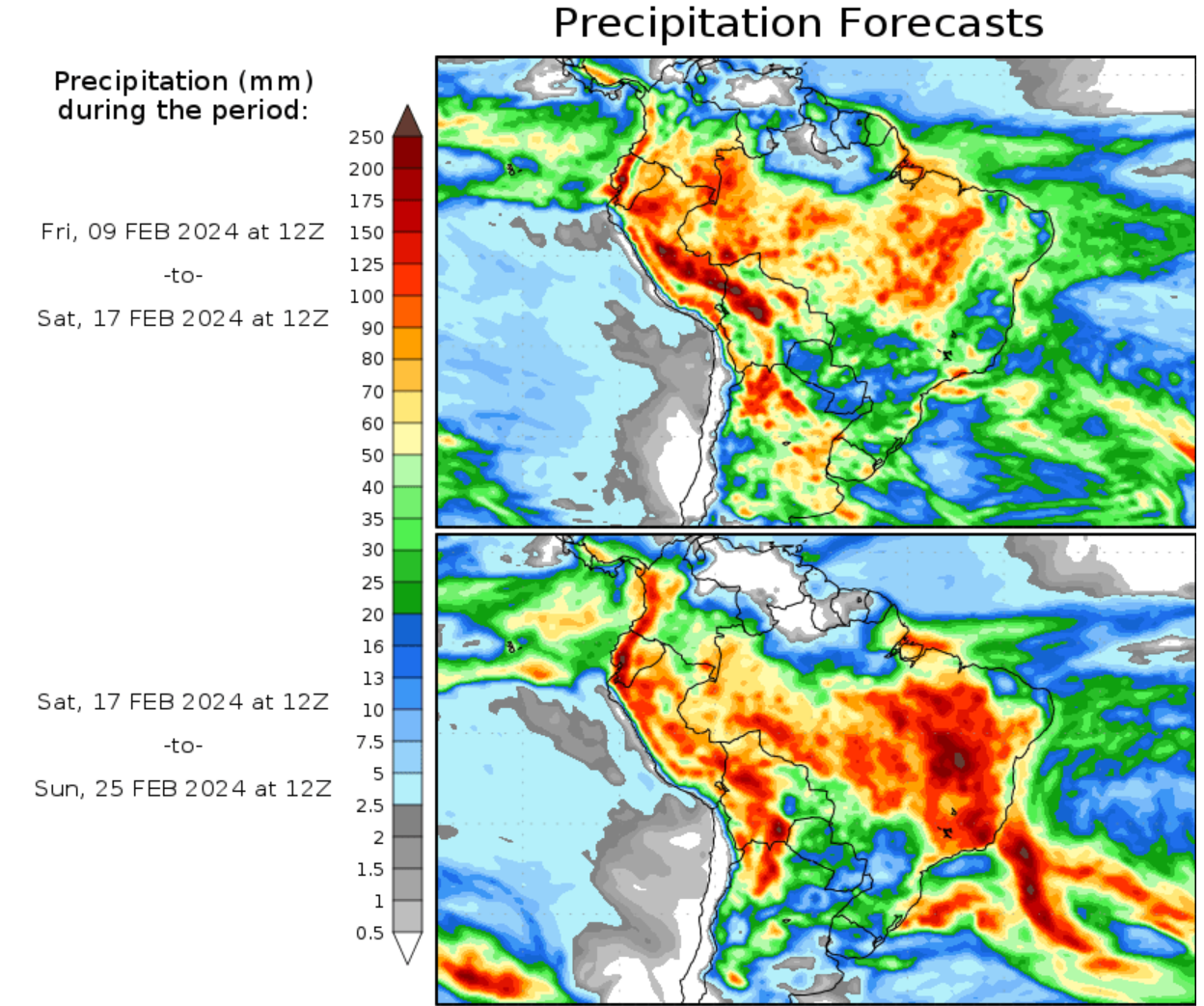

The USDA’s February WASDE report had tweaks to the U.S. corn, wheat and soybean balance sheets, while bean meal and oil situations were left completely unchanged. Without much news for the markets to focus on regarding this month’s WASDE report, the near-term focus is expected to remain on South American crop and weather, with weather forecasts being mostly favorable for the next few weeks.

Highlights on Corn:

USDA cut 10mil bu off Food/Seed/Industrial demand

Moved stocks to use up from 14.8% to 14.9%

Highlights on Beans:

USDA cut exports by 35 mil bu

Moved carryout up from 280 to now at 315 mil bu

RJO’s Randy Mittelstaedt’s comments on USDA/CONAB Reports: “USDA trimmed their estimate of the Brazilian corn crop to 124.0 MMT from 127.0 MMT (137.0 MMT last year), prompting a reduction in estimated Brazilian corn exports to 52.0 MMT from 54.0 MMT previously and compares to 56.0 MMT last year. On the topic of Brazil, yesterday’s revisions by CONAB further distanced their official view of the corn situation from USDA as they cut their ideas of the corn crop to 113.7 MMT from 117.6 MMT previously, now 10.3 MMT lower than USDA, vs their estimate of last year’s crop at 131.9 MMT which is 5.1 MMT smaller than USDA’s reflection of the 22/23 crop at 137.0 MMT. Additionally, CONAB is estimating new crop corn exports at just 32.0 MMT, down 3 MMT from last month’s estimate and down a massive 23.5 MMT (925 million bushels) from their old crop export estimate of 55.5 MMT, which appears likely to prove closer to 53.0 MMT when final marketing year month official data for February is available. CONAB pegs old crop ending stocks at 6.4 MMT vs USDA’s 10.3 MMT estimate, which helps explain some of the lower export ideas for the coming year, but it will ultimately come down to the size of the safrinha crop in determining this year’s export potential, which we feel CONAB is too pessimistic on at 88.1 MMT, down from 91.2 MMT last month and 102.4 MMT last year.

To put the South American situation in better perspective, even with CONAB’s very pessimistic export ideas, using their 32.0 MMT export estimate and USDA’s 41.0 MMT Argentine export estimate, combined exports of 73.0 MMT compared to old crop combined exports likely to prove around 76-77 MMT for only a 3-4 MMT decline. If, on the other hand, USDA is closer to being right with their 52.0 MMT Brazilian new crop export ideas, combined with 41.0 MMT in exports from Argentina, total South American new crop exports of around 93 MMT would be up 15+ MMT from last year. Based on these ideas, it is hard to imagine USDA indicating anything more than modestly higher export prospects for 2024/25 in their initial unofficial look at the new crop balance sheets to be released late next week at the Ag Outlook Conference February 15-16.”

Basis Update:

Processors in Eastern NE/Western IA getting enough corn and bordering on full side with reduced hours. Some markets putting a cash carry into March; however, with neutral to lower board movement front end basis is not relaxing as much as deferred (March) actually improving going into a historically heavier hauling period.

Southern basis is soft nearby without much to look forward to. Feed mills are likely going to hand to mouth because they can easily source cheap corn from the ECB and there's plenty of it locally. Any and all quick ship prems should be taken advantage of.

Weather:

Economy:

Stocks are on a record-setting run. For the first time in history, the S&P 500, the broad-based U.S. index of the largest and best-known companies in the world, is above 5,000. The S&P 500 opened over the milestone mark at the opening bell on Friday. This comes a day after it touched the level for a brief moment before settling lower. "Investors are feeling optimistic that we have sidestepped a recession," says Sam Stovall, the chief investment strategist at the financial research firm CFRA. The latest economic data seem to indicate the Federal Reserve is getting close to executing a so-called "soft landing" for the U.S. economy. That's despite widespread fears of a recession last year. The S&P 500 is up more than 5% so far this year, on the heels of a strong year when the index gained 24%.

A foreign aid package for Ukraine and Israel is making its way through the Senate. On Thursday, a $95 billion foreign aid funding bill for Ukraine and Israel passed the first procedural vote in the Senate. The bill includes $60 billion for Ukraine, $14 billion for Israel, and $9 billion for humanitarian assistance in Gaza. Border security and immigration reform that had been previously negotiated are not included in the bill. The bill will still need to pass one more vote in the Senate before heading to the House of Representatives. Given the increasing resistance to Ukraine aid among House Republicans, the bill's passage through the chamber looks to be difficult.

Americans now own a collective $1.13 trillion on their credit cards, an all time high, per the Federal Reserve Bank of New York.

Something That Probably Means Nothing:

The cost of a 30-second ad during the first Super Bowl in 1967 was $42,500. In 2024, it’s $7 million. (That’s $230,000 per second if your calculator works the same way as mine.)

Last year’s Super Bowl was the most-watched U.S.-based telecast in history with 115.1 million viewers. Fox raked in more than $600 million in ad revenue from the event, and this year’s host, CBS, is projected to surpass that, earning $650 million.

Quote of the Week:

“Anything can be changed. Anything can be fixed. Things that are broken can be fixed. And you don’t have to be some billionaire or millionaire to do it. You just have to be a person with a vision and the passion to do it and be willing to fight for it every day.” – Dana White