2.16.24 Tredas Weekly Recap

*Markets will be closed Monday for Presidents Day

Weekly Action:

Corn Mar24 down 14 at $4.17

Beans Mar24 down 12 at $11.73

KC Wheat Mar24 down 34 at $5.68

Hogs April24 up 4.074 at $85.224

Fats April24 up .65 at $187.375

Feeders Mar24 up 3.825 at $250.975

Corn Dec24 down 10 at $4.58

Beans Nov24 down 14 at $11.50

KC Wheat Jul24 down 40 at $5.55

New Crop Bean/Corn Ratio: 2.51

Crop Insurance Price so far:

Dec24 Corn: $4.69

Nov24 Beans: $11.65

Market Recap:

The USDA Ag Outlook Forum occurred this week. Here are some takeaways:

Corn:

The USDA estimated 2024/2025 ending stocks of 2.532 billion bushels, which would be the largest carryout since 1987 (37 years). If realized, this would result in a stocks-to-use ratio of 17% and would be the highest since the 2005/2006 crop year. It is worth noting the USDA’s Outlook Forum ending stocks have been overstated each of the past five years compared to final ending stocks. They project corn plantings to be 91.0 million acres vs 94.641 last year.

Soybeans:

The Outlook Forum predicted a 435 million bushels carryout, which is up 35% compared to this last year and would be the highest since 2019. This was driven in part by a projected increase of 3.9 million acres more than last year for a total of 87.5 million acres. The Outlook Forum carryout has been higher than the final ending stocks 12 of the last 16 years.

Wheat:

The Outlook Forum projects ending stocks to be highest since 2020, even with a 2.6 million acre decrease in planted acres from last year. Russian ag consultant IKAR projects the Russian crop to be 93 MMT, which would be a record by 1 MMT. U.S. winter wheat area experiencing drought is at 12% this week, compared to 57% this time last year.

Total gross planted acres of grains and oilseeds are projected to be 225.5 million acres, which is lower than the 227.8 million last year and but an increase from 221.4 million in 2022. With this information out of the way, the trade will shift focus to weather.

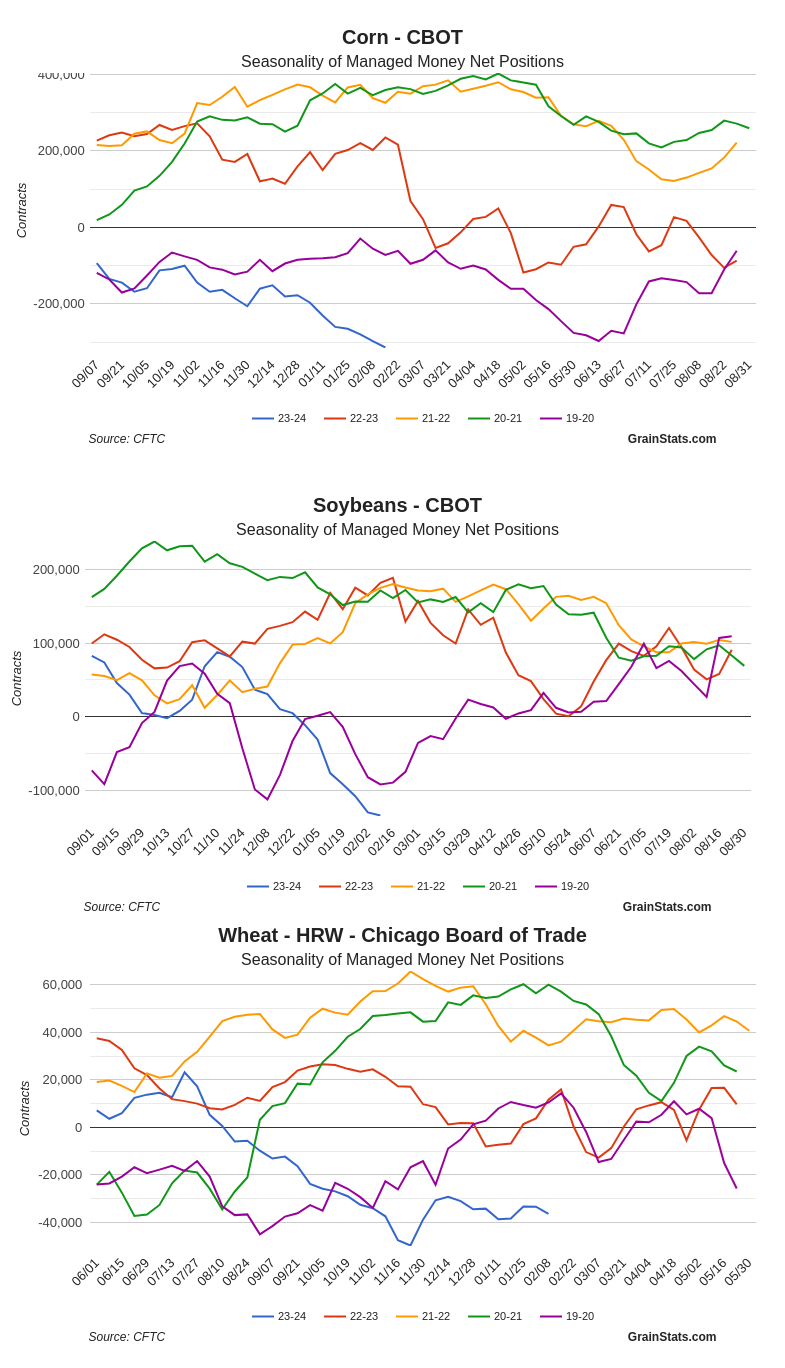

Managed money continued selling this week, growing their record shorts for this time of year. Funds sold 16,000 corn contracts (short 314k) and 4,000 contracts of soybeans (short 134k). The graphs below from GrainStats.com show the size of fund shorts during this time of year compared to previous years. The blue line is the current year.

Weather:

The Buenos Aires Grains Exchange noted Argentine soil conditions have improved following a week of widespread rains. It reports 73% of Argentina’s soybeans are in areas of adequate soil moisture. This is a dramatic improvement from 60% just a week ago. Forecasts indicate good rains in the 6-10 day Argentine forecast and call for Brazil to see regular rains over the next two weeks.

Benign weather is expected across the corn belt next week.

Economy:

U.S. Consumer Price Index increased 0.3% in January and 3.1% annually, which was much higher than the market expected. This is a signal the Fed may continue its “higher for longer” path. The odds of a March Fed rate cut is seen at 9% after a hotter-than-expected inflation report. Just one month ago the probability was seen as 77%.

U.S. Retail Sales fell 0.2% over the past year, which is this first YoY decline since May 2020. On an inflation-adjusted basis sales were down 3.2%.

Investors bought 26% of low-priced homes sold in Q4 2023, which is the highest share on record.

Jeff Bezos has sold $6 billion of Amazon stock this week.

Price increases over the last 10 years:

Auto Insurance: +85% (+21% this year)

Auto Maintenance & Repair: +50%

Overall US Consumer Prices (CPI): +31%

Something That Probably Means Nothing:

The U.S. birthrate has fallen up to 20% since 2012. Today, about 35% of women ages 25-44 have never given birth. That is double the same age group in 1976.

The Wall Street Journal reported the Chinese population will be just 525 million people by the year 2100. Their current population is 1.4 billion people.

Quote of the Week:

“I would rather be on my farm than be emperor of the world.” – George Washington