10.10.25 Tredas Weekly Recap

Weekly Action:

Dec25 Corn down 6.5 at $4.13

Nov25 Beans down 10.25 at $10.0675

Dec25 Chi Wheat down 16.25 at $4.985

Dec25 KC Wheat down 12.75 at $4.83

Dec25 Cotton down 146 points at $0.6384/lb

Dec25 Hogs down $3.275 at $84.025

Dec25 Fats up $8.025 to $242.525

Nov25 Feeders up $20.475 to $375.9

Dec26 Corn down 8.5 at $4.5325

Nov26 Beans down 9 at $10.5675

July26 Chi Wheat down 17.5 at $5.395

July26 KC Wheat down 14.25 at $5.34

Dec26 Cotton down 88 points at $0.6793/lb

Grains:

Grain futures held the week steady until breaking to the downside during Friday’s trade session. Corn was slightly down this week, whereas beans plummeted mid-day, finding support near $10 on November 2025 futures and closing at $10.07

Corn harvest is coming into full swing throughout the corn belt, with many producers seeing mixed harvest results. Some producers are reporting either side of APH/typical production, with others reporting large swings in their anticipated yields. Odd weather patterns throughout the corn belt are part of this variation, and with the government closure lasting through this week, anticipated crop progress reports will not be released. The USDA calendar is clear through the end of the year, with no scheduled publications expected until the government re-opens.

Soybeans had a spurt of positive news last week with President Trump stating he would meet with Chinese President Xi Jinping in the near future. This took a turn on Friday, however, with the U.S. President posting a message to Truth Social, berating the Chinese government on how they are handling rare earth metal trade. He stated that this anticipated meeting, with an emphasis on “making soybeans, and other row crops, great again” will not be happening as stated last week. Soybean futures tumbled over the next thirty minutes, finding support at $10.025, and closing the day slightly up from the day-low.

Livestock:

Lean hog futures this week turned around, breaking through support at $86 and $84. No news in this market has turned out, and with the lack of a Commitment of Traders report since the government shutdown, one could only assume that funds may be covering their previously record long position in this market.

Fat cattle marked a week of nothing but green, showing no signs of fault in this market. Dec live cattle futures marked a solid $8 in gains, and indicators show no sign of weakness in that market.

Along with fats, feeder cattle had a week of strong gains. New contract highs were made, with November feeder cattle marking $376.75/cwt as a high on Friday. The nearby feeder/fat cattle spread has continued to mark new highs, and this week is no exception. Below is a chart provided by AgResource detailing this spread historically.

Weather:

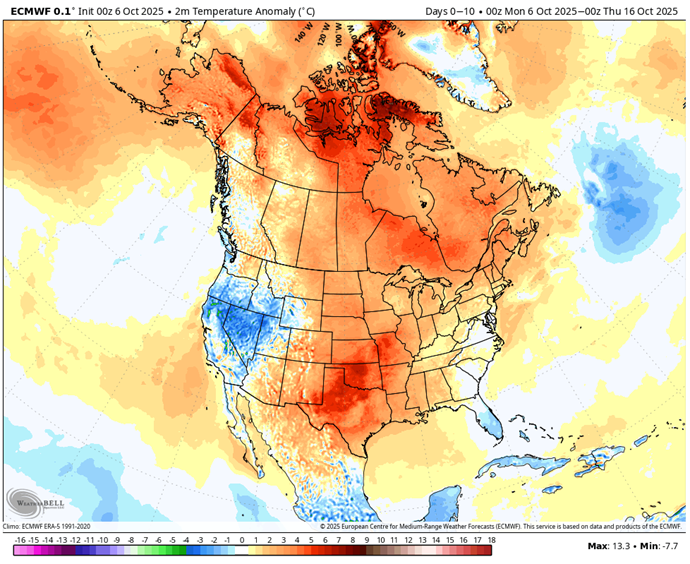

A warm and predominantly dry pattern continues to dominate the Central U.S., allowing corn and soybean harvest to progress rapidly through its “gut slot.” Despite a few light, scattered showers—mainly across the Northern Plains and parts of the Eastern Midwest—fieldwork delays remain minimal due to parched soils. Forecast models (EU and GFS) agree on continued dryness through October 20th, followed by a potential shift to a wetter pattern in the 11–15 day period. Below is a chart provided by AgResource.

Economy:

Government Shutdown Impact:

Shutdown costing U.S. economy $15 billion a week. The National Economic Director warned that the ongoing government shutdown could reduce GDP growth by $7 billion weekly and lead to tens of thousands of job losses.

Stock Market and Inflation:

Markets recovered after initial losses, suggesting investor optimism or resilience despite political gridlock.

Something That Probably Means Nothing:

This week, average daily temperatures across much of the Midwest have been 4–12 degrees above normal — the kind of warm streak that’s great for harvest. But fun fact: historically, when October heats up this much, the following winter tends to be colder than average. So, enjoy the warmth now… or maybe start digging out your stocking hats early.

Quote of the Week:

“The harvest is not the end of the hard work; it’s the reward for trusting the season.” -Unknown