10.3.25 Tredas Weekly Recap

Weekly Action:

Dec25 Corn up 10 to $4.28

Nov25 Beans up 18.25 to $10.45

Dec25 KC Wheat up 8 at $5.13

Dec25 Cotton up 74pts to $0.6677/lb

Oct25 Hogs up $1.100 to $97.125

Oct25 Fats down $6.000 to $229.975

Nov25 Feeders down $9.425 to $350.400

Dec26 Corn up 9 to $4.67

Nov26 Beans up 11 to $10.81

July26 KC Wheat up 8 at $5.60

Dec26 Cotton up 50pts at $0.6938/lb

Grains:

Grains finished higher on the week following several discussion worthy updates/events. The first being Tuesday’s September USDA Quarterly Stocks Report. The report featured a surprisingly high 24/25 corn carryout of 1.532bil bushels vs an average estimate of 1.337bil bushels. Adding roughly 200mil bushels of old crop carryout to 25/26 crop would put our new crop corn carryout in the 2.3bil bushel range using the most recent WASDE values. Soybean carryout came in at 316mil bushels vs 323mil bushels estimate.

Markets closed lower on report day and followed through with a negative start to Wednesday’s trade. However, markets came charging back into the afternoon following an announcement from Trump that he’d be meeting with President Xi of China in four weeks to discuss soybeans. This gave the soybean market a timely spark as the Nov25 futures were struggling to hold above the 10.00 level. Trump’s announcement also mentioned his intent to put together an aid package for soybean producers using a portion of tariff revenue. While this may be good news for US producers, government aid packages typically take time to put together, so it could be awhile before checks hit the farmer’s mailbox. The fact our administration is now working on an aid package might suggest low optimism for a timely resolution to the China trade talks. Hopefully Trump’s discussion with President Xi in the coming weeks will get us closer to an agreement.

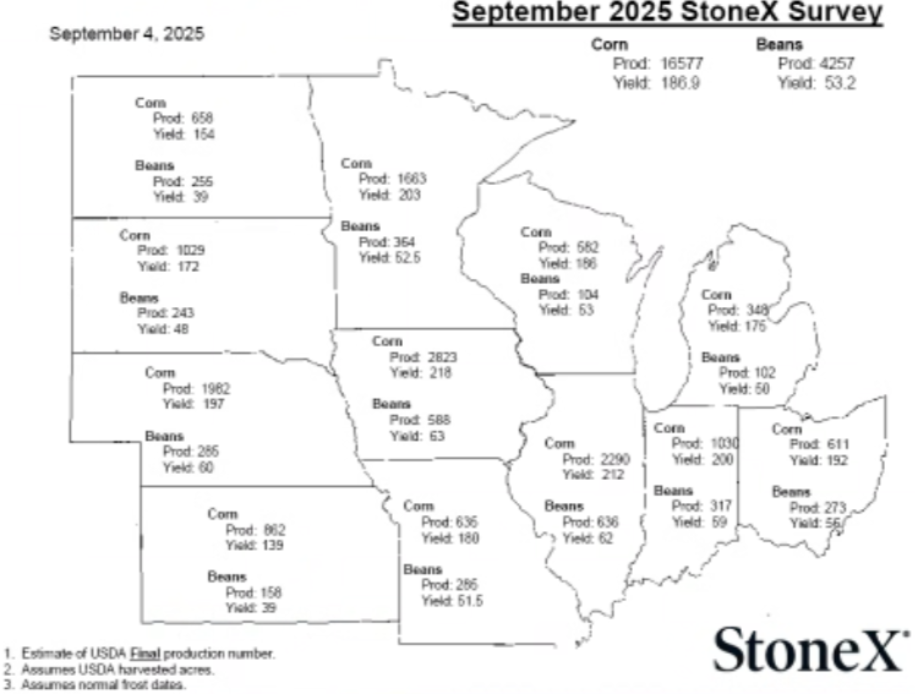

As harvest progresses, there are many reports of variable corn yields and generally good soybean yields. StoneX’s updated yield map, attached below, reflects the same. The October update shows a 1.0bu drop to US corn yield at 185.9 and 0.7bu increase to US soybean yield at 53.9.

In cash markets, we’ve seen quick ship bids for early harvest bushels fade as we transition into October. Overall, harvest bids have been neutral to slightly weaker this week at many major ethanol plants & soybean crushers.

Weather:

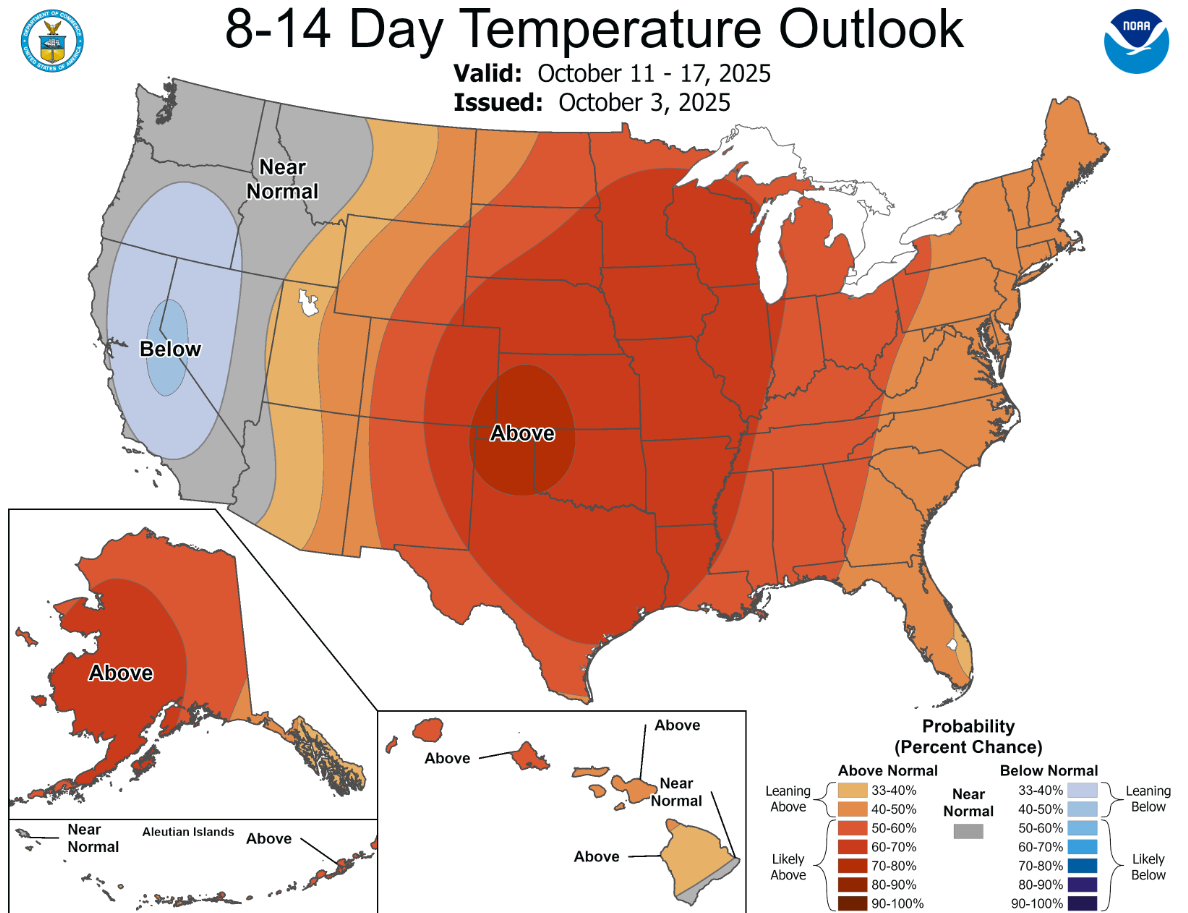

Forecasts suggest slightly above normal precip for the western half of the US & slightly below normal for the eastern half. Some rain is projected for parts of the corn belt early next week. As far as temps go, the majority of the US is projected to see above normal temperatures for the next two weeks.

Economy:

China is pressing the Trump administration to ease national-security restrictions on Chinese deals in the U.S., offering the prospect of a massive investment package in return. Beijing’s proposals include lowering tariffs on Chinese inputs used in U.S.-based Chinese factories and shifting Washington’s stance on Taiwan. The potential package is being framed as something that could upend a decade of U.S. policy; while a $1 trillion figure had been floated earlier this year, the current size is less clear. The proposals came up in trade talks in Madrid last month, where negotiators also touched on allowing Chinese firms like TikTok to keep operating in the U.S. despite bipartisan security concerns in Congress.

US Treasury Secretary Scott Bessent said that President Trump and President Xi will meet on the sidelines of the upcoming Asia summit, stressing that the two leaders respect each other and that the next round of negotiations should yield a breakthrough. He also confirmed that the current U.S.–China trade truce is set to expire on November 10, according to Reuters.

The Trump Administration is weighing $10-14B in farm aid. Expecting to hear more news on Tuesday. (RJO Commentary)

Something That Probably Means Nothing:

Government shutdown.

Quote of the Week:

“MAKE SOYBEANS AND OTHER ROW CROPS GREAT AGAIN!” - DJT