1.16.26 Tredas Weekly Recap

Weekly Action:

Mar26 Corn down 21 at $4.2475

Mar26 Beans down 5 at $10.5775

Mar26 Chi Wheat unchanged at $5.18

Mar26 KC Wheat down 4.25 at $5.2725

Mar26 Cotton up 25 points to $0.6466/lb

Feb26 Hogs up $2.975 to $88.275

Feb26 Fats down $1.575 at $232.15

Jan26 Feeders up $1.2 to $361.925

Dec26 Corn down 14 at $4.4975

Nov26 Beans down 2.75 at $10.69

July26 Chi Wheat down 0.75 at $5.405

July26 KC Wheat down 6.5 at $5.51

Dec26 Cotton up 23 points to $0.6906/lb

Markets are closed on Monday, January 19th for Martin Luther King, Jr Day.

Grains:

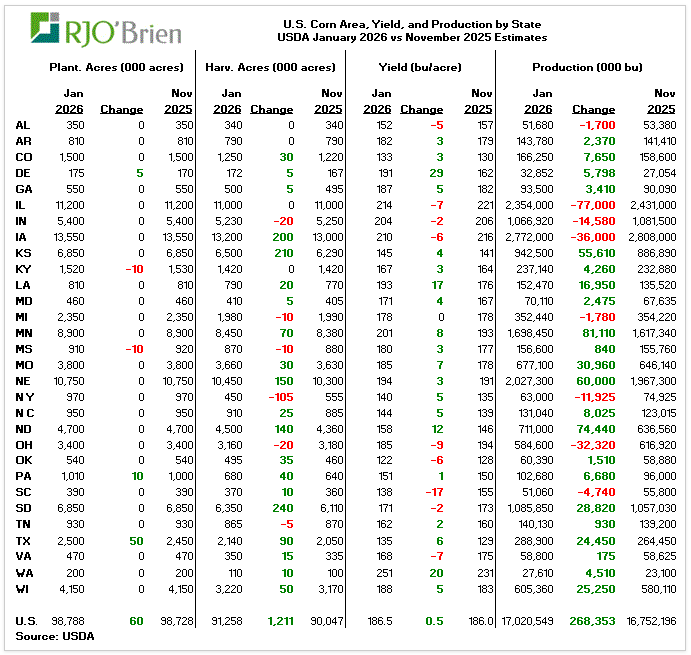

The week started off in a selloff following a bearish USDA report. The largest shock was a higher corn yield at 186.5 and an additional 1.2 million harvested acres. The silver lining to a lower corn market is hopes that basis improves for hedged corn. Also, it is important to understand that the ARC/PLC is roughly 45% priced, and the remaining 55% will be protected at these levels. Reminder on how those payments will be made is your Base Acres*PLC yield*85%. If you haven’t figured those bushels yet, it’s crucial to understanding how those programs will benefit your farm.

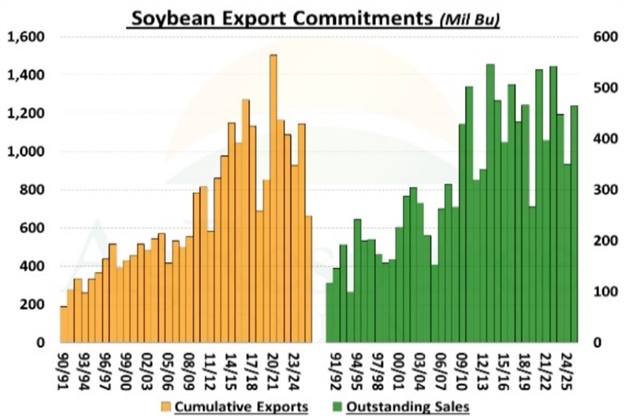

Soybean futures were lower post report but rallied Thursday following reports the Trump administration plans to finalize biofuels blending quotas by March, potentially setting the stage for higher production of biomass-based diesel. Higher blending targets could provide a much-needed demand boost to help offset lost export business. Looking at exports, as of Thursday, known soybean commitments to China and unknown destinations totaled 12.334 MMT. While not all unknown purchases were by China it appears safe to say China is very close to, if not completed with the 12 MMT of soybean purchases they agreed to via the late-October trade deal. It’s visible below that US cumulative sales pace has been slow without China.

Weather:

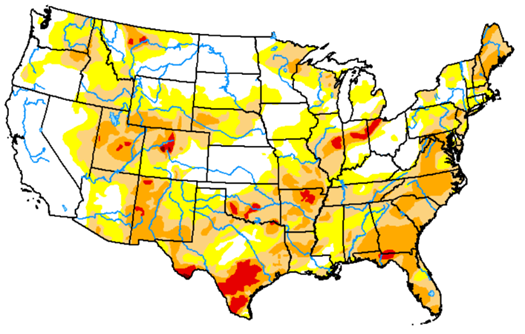

Though it’s very early to discuss dryness, winter moisture has been below average and temps have been above. This trend doesn’t appear to change on near-term weather models.

Livestock:

Live and Feeder cattle had a great week up until Friday. News of multiple cases of New World Screw Worm were reported North and South of the border. All are rumors at this point. Feeders were down $9 and live down $6 at one point. Cash was steady to end the week even with the $4 selloff in February futures. Lexington shutting down should give packers some leverage so keep persistent on market ready cattle. Current packer margins are estimated at over $100/head losses.

Economy:

(RJO’Brien) Precious metals are taking a breather after the defusing of Iranian tensions yesterday. President Trump pulled back on his threat to attack the country and its airspace reopened. Many airlines are still avoiding flying over Iran, however. That had led to the sharp selloff in oil prices yesterday, but some recovery is seen in oil markets today. Venezuela’s interim president proposed hydrocarbon law reforms and has continued to work with the US on redeveloping the country’s oil industry

Something That Probably Means Nothing:

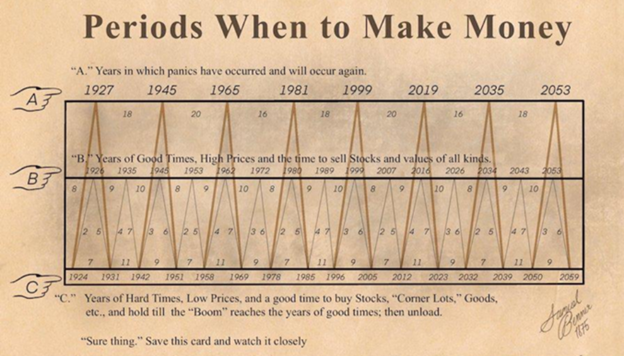

Sammuel Benner was a farmer in the 1800s who published a book forecasting business and commodity prices. This is a short version of the current time.

Quote of the Week:

In honor of MLK Jr. “You don’t have to see the whole staircase, just take the first step.”

Have a great weekend!