1.9.26 Tredas Weekly Recap

Weekly Action:

Mar26 Corn up 2 to $4.4575

Mar26 Beans up 16.75 to $10.6275

Mar26 Chi Wheat up 8.25 to $5.18

Mar26 KC Wheat up 16.25 to $5.315

Mar26 Cotton up 66 points to $0.6441/lb

Feb26 Hogs up $1.2 to $85.3

Feb26 Fats down $2.275 at $233.725

Jan26 Feeders up $4.625 to $360.725

Dec26 Corn up 1.75 to $4.6375

Nov26 Beans up 4 to $10.7175

July26 Chi Wheat up 9.5 to $5.4125

July26 KC Wheat up 16.5 to $5.575

Dec26 Cotton up 153 points to $0.6883/lb

Grains:

Corn markets showed modest gains during Monday’s trading session, marked by quiet trade throughout the rest of the week. Range-bound trade has been the name of the game, with March futures struggling to break above $4.50 and below $4.35. Basis in the Omaha/Columbus markets have stayed relatively firm, backing off from a recent push during the last week of December and settling around -10H for January delivery. Soybean futures showed strength early this week and choppy trade to follow, ultimately clawing back gains to settle above $10.60 March futures on Friday’s close. China has made a slew of purchases this week, putting their total 2025 import commitments over 11Mbu out of the 12Mbu pledged to buy. Various sources have slated the 12Mbu commitment to be concluded by the end of February, with others stating that it is for the entire marketing year of 2025 crop. Time will tell if the end of exports to China falls exactly at 12Mbu, or if demand will continue to grow throughout the year.

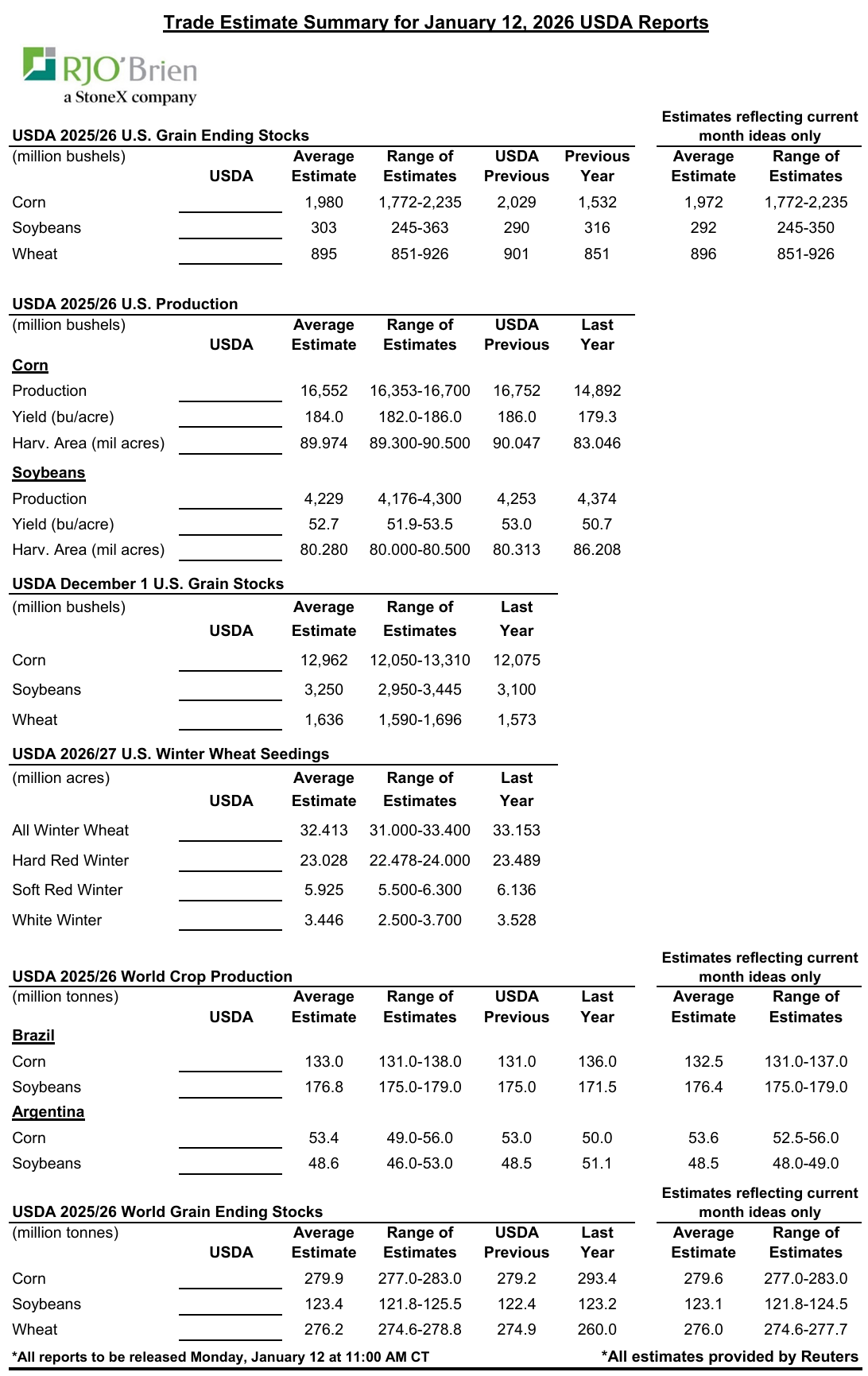

The January WASDE report releases on Monday, January 12th at 11:00 AM central time. The report combines several major reports at once, including Annual Crop Production, Grain Stocks, WASDE, and Winter Wheat Seedings. Because these reports can interact with one another, a surprise in one category can ripple across balance sheets and trigger market fluctuations. With delayed data now fully incorporated after the government shutdown, this will be the USDA’s first opportunity in months to meaningfully reassess supply and demand.

Corn - general market consensus is USDA’s current yield estimate of 186.0 bu/acre may be overstated - while late-season crop conditions were strong, historical relationships suggest a lower final yield is possible. Average estimates of US Grain Ending Stocks are 1.7 up to 2.2 billion bushels with RJO falling in the middle at 2.0 billion bushels—levels not seen since 2018/19. Feed and residual usage is viewed as the biggest downside risk, as current USDA projections appear lofty given livestock numbers, while exports and ethanol demand remain supportive but insufficient to tighten the balance sheet meaningfully.

Soybeans face a different challenge, with the primary issue being demand rather than supply. While yield risk is also skewed slightly lower, any modest production cuts are overwhelmed by an exceptionally weak export program, especially to China even as they near completion of their agreement. First-quarter soybean exports were the lowest in 14 years, leading to sharply higher December 1 stocks despite a smaller crop than last year. Crush demand is a bright spot and likely underestimated by USDA, but overall the report expects soybean ending stocks to rise above current USDA estimates, keeping pressure on prices.

Livestock:

Fat cattle futures have had a week marked with struggle to trade above prior chart consolidation. During the first run to all-time highs, Feb 26 fat cattle futures spent a considerable amount of time trading between the $230-$245 range. After closing a chart gap last Friday, January 2nd, fat cattle futures are having trouble sustaining futures above $235 and have settled just below $233 going into the weekend. Feeder cattle futures share a similar story, with January finding resistance around $364 and March failing to break $360.

Lean hog futures have been trading in a rising wedge pattern. Looking towards June futures, the seasonal tendency is appreciation into the beginning of summer.

Economy:

Wall Street was sitting on edge all week, waiting for the reveal of the Supreme Court’s ruling on President Trump’s use of tariffs under the International Emergency Economic Powers Act, and if unlawful, if the U.S. will reimburse importers who have already paid these duties. This decision was supposed to come on Friday, but the Supreme Court has stated they will release their decision on Wednesday, January 14th.

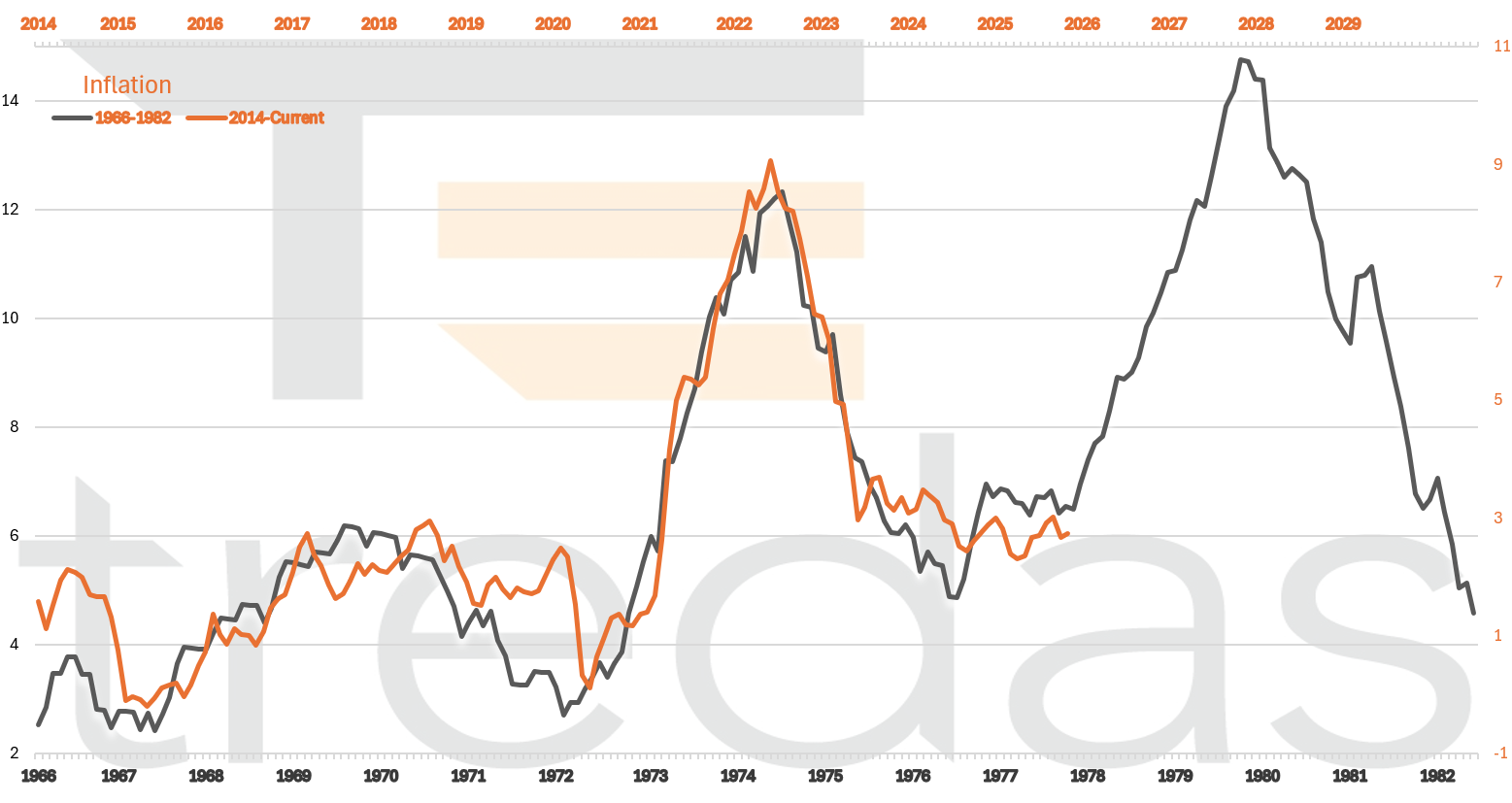

As a nation, the U.S. experienced slower inflation growth than anticipated over the year of 2025. While this may seem like a good thing, some are doubting the safety of the “bubble” we are currently riding. Looking to the past and comparing that to the present, below is an internal study comparing inflation from 1966-1982 in grey, and 2014-present day in orange.

Something That Probably Means Nothing:

Nebraska basketball is currently undefeated, 15-0, for the first time in school history, and ranked in the top 10 for the first time since 1966. As current nationwide standings sit, ESPN Bracketology has Nebraska placed as a 3-seed in a hypothetical NCAA tournament. Will this be the year Nebraska lands its first tournament win? Nobody knows, but the Huskers take on the Indiana Hoosiers Saturday at 11:00 AM central time in Bloomington, hoping to stay perfect in conference play.

Quote of the Week:

“The most certain way to succeed is always to try just one more time” – Unknown

Have a great weekend!