1.2.26 Tredas Weekly Recap

Weekly Action:

Mar26 Corn down 13c at $4.37

Mar26 Beans down 29c at $10.46

Mar26 Chi Wheat down 12c at $5.0675

Mar26 KC Wheat down 19c at $5.1450

Mar26 Cotton down 48 points at $0.6401/lb

Feb26 Hogs down $0.75 to $84.100

Feb26 Fats up $6.075 to $236.000

Jan26 Feeders up $9.350 to $356.100

Dec26 Corn down 10.75c at $4.5775

Nov26 Beans down 20.75c at $10.6225

July26 Chi Wheat down 13.25c at $5.3075

July26 KC Wheat down 17.25c to $5.4175

Dec26 Cotton down 3 points at $0.6820/lb

Grains:

Corn and soybean futures ended the year and kicked off 2026 mostly on the defensive, with both contracts closing lower on the week.

Soybean’s focus is on the US export market. China’s buying pace remains a key driver but has lost its glimmer. For corn, weekly export sales reports and South American weather conditions would be driver of direction.

Looking ahead with the holidays behind us and liquidity picking back up, the market is waiting on a few catalysts: USDA’s January 12th crop report, updated export data, and any new shifts geopolitically that could quickly translate into price swings.

The CFTC reported that as of December 23rd managed money was net long 110k contracts of soybeans and 2.8k contracts of corn, while being short 67k contracts of soyoil, 6.6k contracts of soymeal and 91k contracts of Chicago wheat. The length in the soybean market could be seen as worrisome ahead of a projected record large South American crop/harvest but as one says “don’t count your chickens before they hatch”. The CFTC and USDA FAS are now caught up on their reporting following the fall government shutdown.

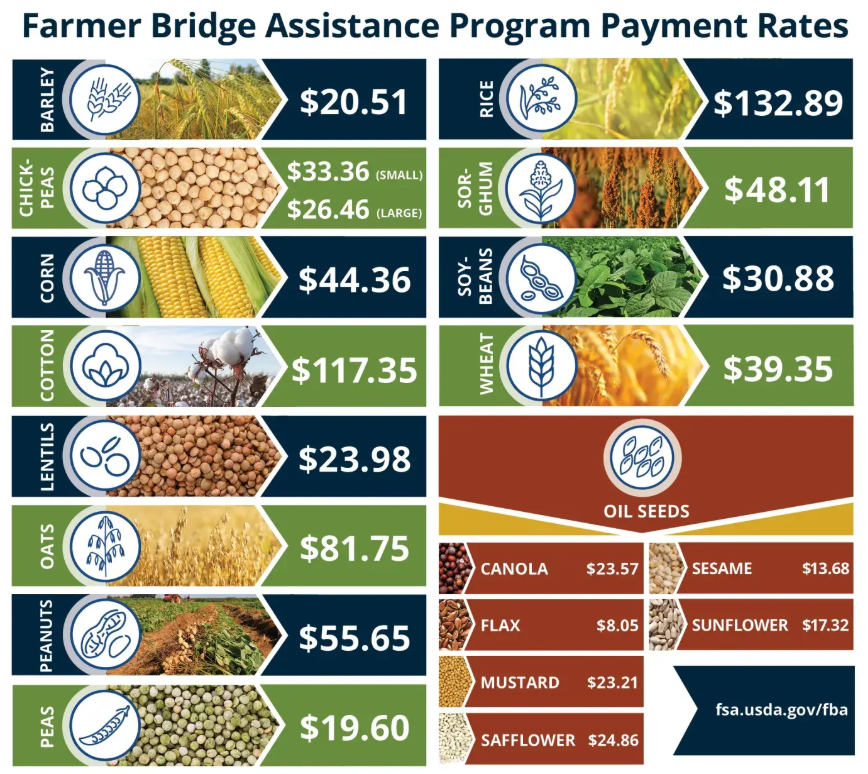

Late Wednesday, the USDA released details on payments to be made to farmers as part of the $12 billion Farmer Bridge Assistance program, with payment rates based on cost of production data and market conditions. Row crop farmers will be paid based on reported 2025 planted acreage at $44.36/acre for corn, $30.88/acre for soybeans, $39.35/acre for wheat, $117.35/acre for cotton, $81.75/acre for oats, $48.11/acre for sorghum, $20.51/acre for barley and $132.89/acre for rice. Payments are expected to hit accounts by February 28th.

Livestock:

Cattle closed higher on the week with a breakout above previous 3 weeks of trade. Leading the news cycle were two reports of screwworm being found within 200 miles of US border. More concerningly – one of those cases being in a six-day old calf in the northern part of Mexico whereas previous reported cases that close to border were from cattle that were recently transported from southern parts up north.

Commitment of Traders data for 12/23 showed Managed Money moderately increased their net long to just under 95k contracts.

Weather:

South American weather forecast is nonthreatening for Brazil with ongoing near normal rainfall and lack of heat. Argentina will remain dry for the next 7-9 days with moderate temps with rain chances returning in the 10 day forecast. Weather conditions over the next 3-4 weeks will help determine size of final crop yields.

Economy:

Over the last few days the U.S. economic picture has felt pretty mixed — not booming, but definitely not falling apart either. The labor market is showing some resilience with weekly jobless claims dipping below 200,000, even though hiring overall has been sluggish and unemployment ticked up a bit late last year. GDP data from late 2025 continues to look solid, with the economy growing faster than many expected before the government shutdown.

Consumer behavior during the holiday shopping season pointed to continued spending, hinting that people aren’t tightening their belts too much yet. But beneath the surface there’s a K-shaped trend: wealthier Americans are doing relatively well and spending more, while lower-income families are feeling real strain, pushing overall sentiment lower.

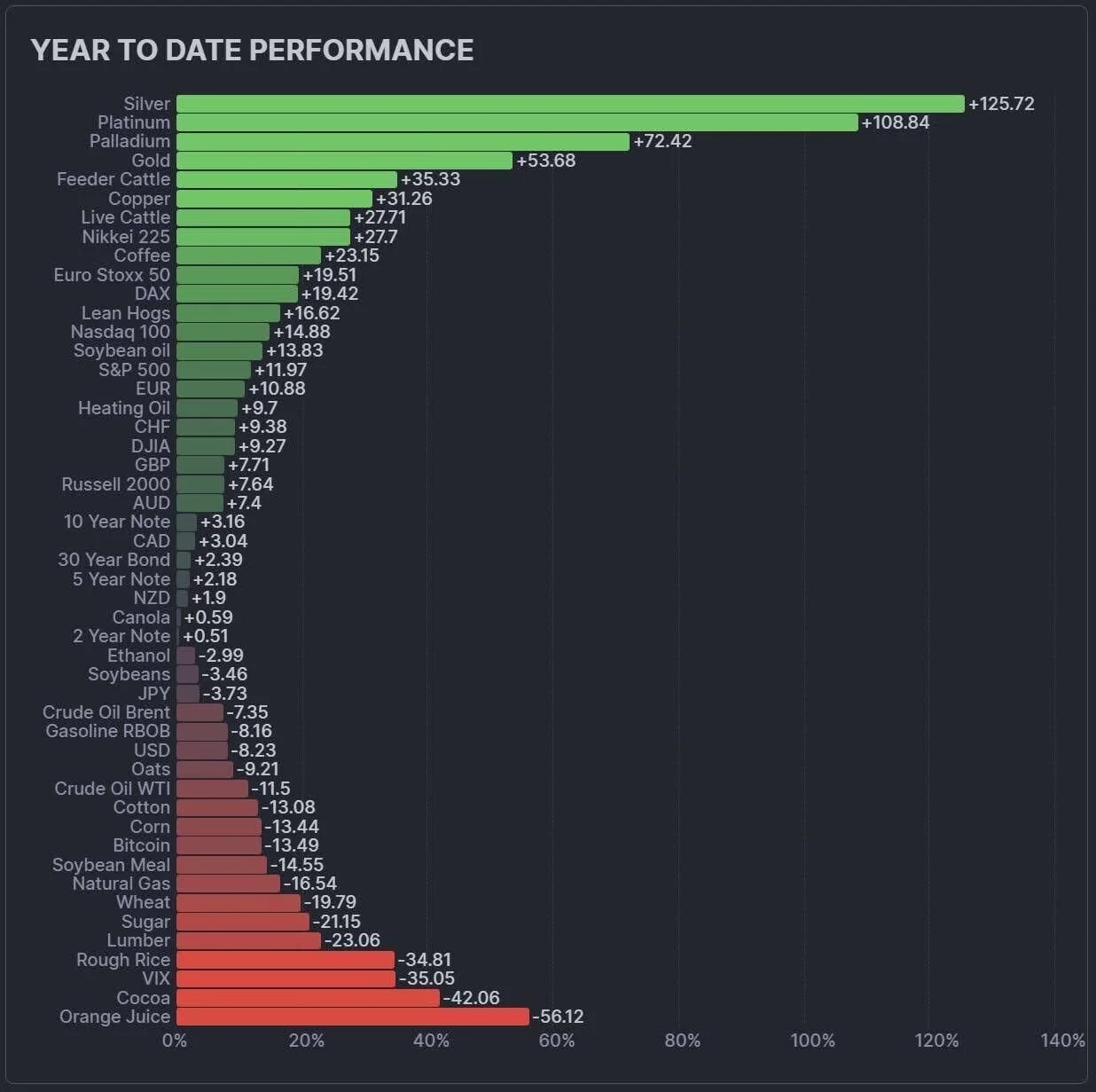

Wall Street wrapped up 2025 on a high with strong equity fund inflows and notable stock gains — especially in AI and tech sectors — though markets started 2026 with a bit of a wobble as early gains faded.

Policy moves are still in the mix too: the Federal Reserve remains divided but signaled that more rate cuts could happen if inflation keeps cooling, and some previously threatened tariffs (like on furniture and cabinets) got delayed — a relief for parts of the consumer sector.

Overall, the economy is showing moderate growth and strong markets, but uneven recovery, persistent inflation pressures, and mixed consumer confidence are all shaping cautious expectations as we head into 2026.

Something That Probably Means Nothing:

Lincoln, Nebraska born (and son of former player/coach at University of Nebraska, Monte Kiffin) Lane Kiffin left Ole Miss after a hugely successful regular season to become the new head coach at LSU, signing a reported seven-year, roughly $91 million contract that pays about $13 million per year and makes him one of college football’s highest-paid coaches.

What’s especially notable is that LSU agreed to honor the postseason bonus structure from his Ole Miss contract for the 2025 College Football Playoff — meaning even though he no longer coaches the Rebels, he’ll still receive the bonus payouts he would’ve earned at Ole Miss as their head coach as they advance through the playoffs.

So far that’s already paid him about $500,000 from Ole Miss’ CFP wins, and depending on how far the Rebels go — up to a national championship — he could collect up to about $1 million tied to their playoff success.

Quote of the Week:

“You don’t have to see the whole staircase, just take the first step” – Martin Luther King Jr.

Thanks and have a great weekend!