12.26.25 Tredas Weekly Recap

Weekly Action:

Mar26 Corn up 6.25 at $4.50

Jan26 Beans up 9.5 at $10.5875

Mar26 Chi Wheat up 9.25 at $5.19

Mar26 KC Wheat up 18.75 to $5.335

Mar26 Cotton up 74 points at $0.6449/lb

Feb26 Hogs up $0.02 to $84.52

Feb26 Fats down $1.15 to $229.65

Jan26 Feeders up $0.57 to $346.17

Dec26 Corn up 6.5 at $4.685

Nov26 Beans up 14.25 at $10.82

July26 Chi Wheat up 10.75 at $5.425

July26 KC Wheat up 18 to $5.59

Dec26 Cotton up 94 points at $0.6824/lb

Grains:

The corn market continues to rebound and is now back near the high of it’s recent range and the best prices we’ve seen since mid November. Anticipation is building for the coming USDA report on January 12th that could hold production changes. The Russia/Ukraine war has increased in intensity in recent weeks and uncertainty on exports is helping to support prices. As government reporting continues to catch up weekly export sales have been updated through December 4th this week with cumulative corn exports at 1.8 billion bushels, up 55% from last year. Total soybeans exports are 859 million bushels vs 1.36 billion last year and the lowest in 14 years for this time of year. China is just now starting to ship it’s recent purchases of US beans. Cumulative wheat exports are at 710 million bushels, the highest in 9 years, and represent 79% of the USDA’s annual export projection. An announcement on 45z biofuels is still awaited by the market with a ruling from the EPA/Whitehouse expected possibly by next week or early in 2026. This ruling could have significant implications for the grain and oil markets.

Russia set it’s total grain export quota this week at 20 million metric tons for the crop year Feb 15-June30th. Last year their quotes was 10.6 MMT total and applied only to wheat, which will make up the majority of this year’s exports also. This reflects the increasing competition for world exports in a time where grain stocks, especially wheat, are abundant. Ukraine though has seen it’s exports slip so far this year with 7.7 MMT of wheat sold vs 9.6 MMT last year and 4.4 MMT of corn sales vs 6.6 MMT last year due to the ongoing conflict.

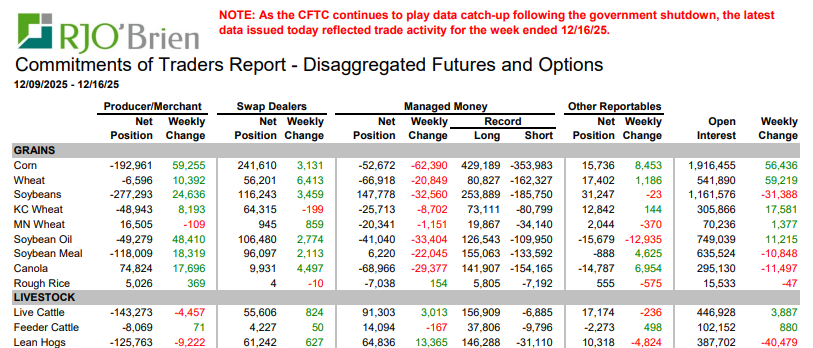

On Tuesday the commitment of Traders report showed positions through December 16th, 10 days behind today, but give an idea of where fund positions may be as we get closer to being fully caught up on reporting.

Livestock:

Live Cattle: Futures continue to trade sideways in a narrow range with the 100 day moving average holding resistance on the topside. Cash trade for live cattle has been around $229, up $2 from last week. Boxed beef prices were lower at midweek with choice down $1.15 and select $3.84 lower. The choice/select spread has increase to an $8.87 choice premium but remains historically tight. Wednesday’s options open interest showed build in the February $224 puts with the $230 strike remaining where the largest volume of combined call/put open interest resides.

Feeder Cattle: Futures are trading sideways to higher and remain slightly below the chart gap from October. The feeder index is down $4.59 today to $349.32 compared to January futures trading at $346.50.

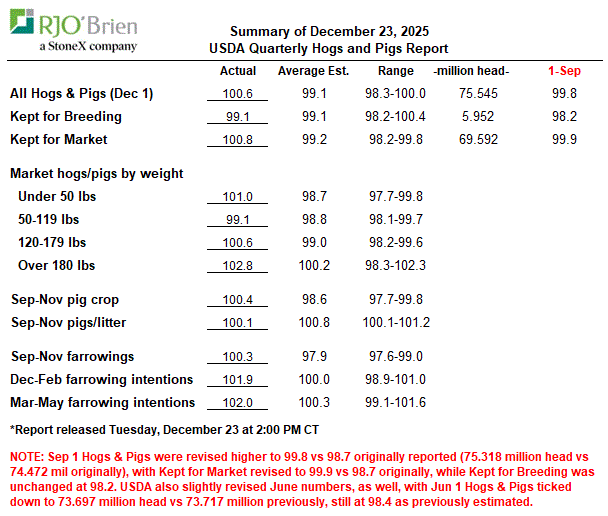

Lean Hogs: The quarterly Hogs and Pigs report on Tuesday showed all hogs and pigs at 100.6% of last year which was solidly above market expectations of 99.1%. Kept for breeding was in line with expectations while kept for market came in well above as well. The current hog index numbers are at 84.06 compared to February futures at 84.45.

Weather:

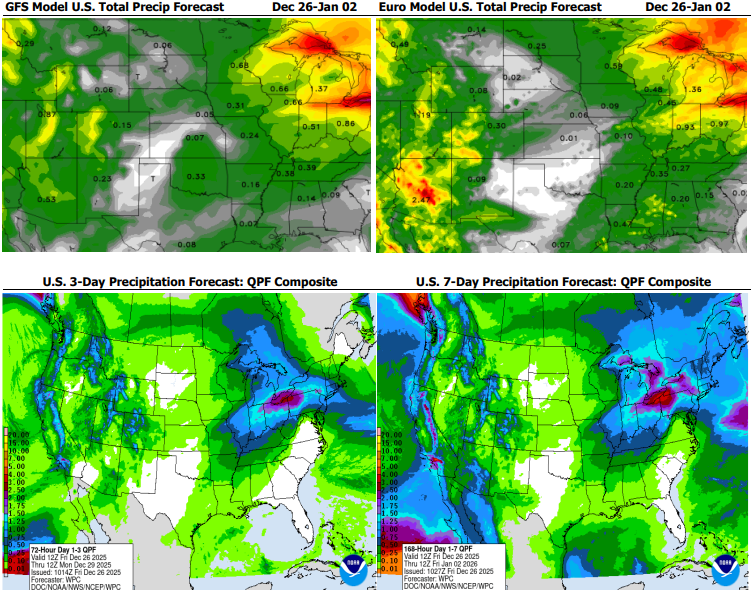

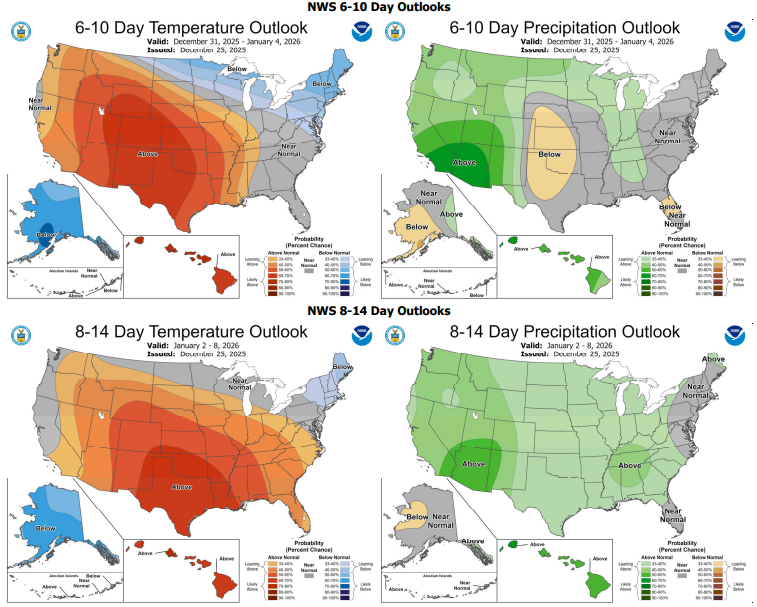

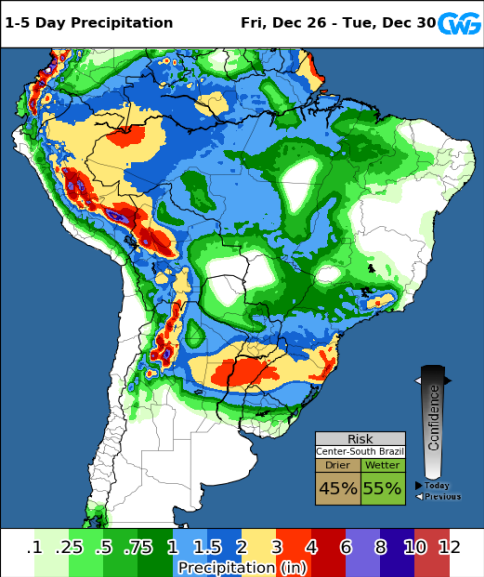

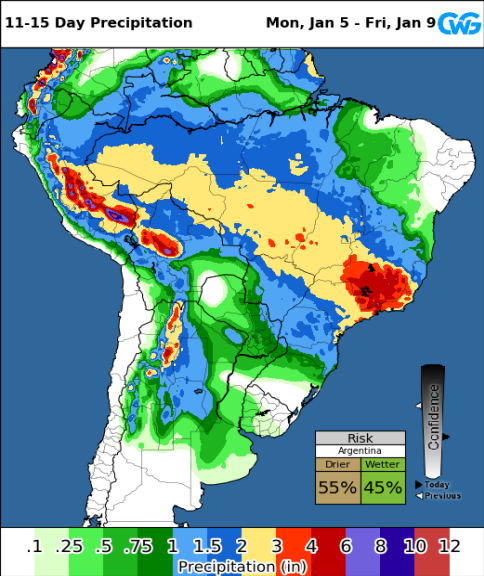

Warm and mild weather dominates the majority of the US with some showers seen in the east, but overall a great window for fall fieldwork and moving grain. South America weather continues to be favorable with the only area of concern right now being slight dryness in southern Argentina.

Economy:

The S&P 500 reached new highs today at 6,945 as traders return from Christmas. Seasonally this is a historically strong period during the last five trading days of the year known as the Santa Clause rally. The Stock Trader’s Almanac shows the S&P averages a 1.3% gain during that time going back to 1950. Precious metals gold and silver are also trading at or near record highs of $4,567 for gold and $78 for silver. Not all sectors of the market are seeing record prices though as AI companies have seen prices drop recently on fears of overspending and slowing income growth. Oracle’s share price has dropped 30% this quarter and CoreWeave lost 50% of is value in November alone stoking fears of a bubble from a sector that has driven much of the stock price growth this year.

Something That Probably Means Nothing:

Around 30 million real Christmas trees are sold annually in the US with about 350 million trees in production across the country.

Quote of the Week:

“Never be afraid when people can’t see what you see. Only be afraid if you no longer see it”