1.23.26 Tredas Weekly Recap

Weekly Action:

Mar26 Corn up 6 to $4.3075

Mar26 Beans up 9.75 to $10.675

Mar26 Chi Wheat up 11.5 to $5.295

Mar26 KC Wheat up 13.5 to $5.4075

Mar26 Cotton down 85 points at $0.6381/lb

Feb26 Hogs up $0.075 to $88.35

Feb26 Fats up $2.75 to $234.9

Jan26 Feeders up $2.875 to $364.8

Dec26 Corn up 5.5 to $4.5525

Nov26 Beans up 13 to $10.82

July26 Chi Wheat up 10.5 to $5.51

July26 KC Wheat up 12 to $5.63

Dec26 Cotton down 5 points at $0.6901/lb

Grains:

Despite last week’s negative USDA report, grains posted modest gains in a shortened trade week. Corn futures saw strong Friday action spurred by larger than expected weekly export figures. Soybean exports were also strong, but within expectations. In addition to the positive export numbers, a combination of dryness in parts of Argentina & bitter cold for the Central US provided short-term support for markets. On the technical side, corn futures are beginning their move to strength and soybean futures are approaching strength/resistance.

As we approach the start of the seasonal timeframe for 2026 crop, the fund position is currently short ~82k contracts of corn and long ~13k contracts of soybeans. Last year at this time, the funds had a slightly larger soybean long position but had built a large long position in corn of almost 300k contracts. They proceeded to exit that position over the coming months, weighing down the corn market. Now holding a net short, there’s room for buying if weather/planting concerns emerge.

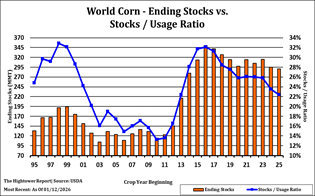

Despite the larger US carryout figures for corn in last week’s report, the world numbers are still the tightest they’ve been since 2013 from a stocks-to-use standpoint (chart below). World ending stocks figures have been relatively flat in that timeframe, however, greater ethanol demand, more cattle production in South America, population growth, and other factors have lowered the S/U ratio. World S/U on soybeans is down from the last two years but not as tight as we were in 2019-2022. This essentially means there’s less room for error with 2026 crops in South America and/or the US, especially with corn.

Considering the fund position, world numbers, and ARC/PLC support levels, it’s highly important to define a marketing approach & operate with your next “play” in mind.

Livestock:

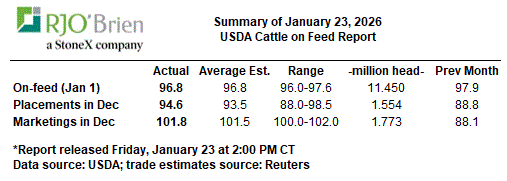

The USDA released the January Cattle on Feed report this afternoon. In this report, cattle on feed Dec 1st were down 255k head (98% of last year), placements were down 88k (95%), and cattle marketed were higher at 1.773M (102%). While YOY marketings were up, this is down 8% across the US from last month. Below are trade estimates vs. actual report numbers by RJ O’Brien

Economy:

The US Stock Market had a turbulent week of trade, with indices down on Tuesday following the announcement of potential trade embargoes and tariffs on nations that did not support the US plans for acquiring Greenland. However, following the World Economic Forum, a framework of a deal was supposedly agreed upon by many parties, and tariff threats ceased. The market has since recovered most of the week’s losses and traded neutral into the weekend.

Something That Probably Means Nothing:

Most of the northern United States has been issued an “exploding tree warning.” What does this mean? In the most simple terms, when the temperature fluctuates quickly, going from above-freezing to well below- freezing, the sap and water stored in trees does not have time to freeze before the solid matter of the tree goes dormant. With this phenomenon, the trees typically don’t explode in the way you think, but rather buckle and pop loudly.

Quote of the Week:

Every action you take is a vote for the type of person you wish to become – James Clear

Have a great weekend!