5.23.25 Tredas Weekly Recap

Weekly Action:

July25 Corn up 16c at $4.595

July25 Beans up 10c at $10.605

Dec25 Corn up 15c at $4.50

Nov25 Beans up 15c at $10.60

July25 KC Wheat up 22c at $5.38

June25 Hogs down 2.025 at $98.300

June25 Fats up 3.580 at $215.800

Aug25 Feeders up 2.775 at $300.375

US Markets will be closed on Monday for Memorial Day holiday. Ag markets will reopen Monday night at 7:00pm.

Grains:

Trump called out Europe on Friday morning for not negotiation in good faith with a June 1st tariff threat of 50%. It’s expected that if a fast deal cannot be found that EU will retaliate with tariffs of their own against US ag goods, putting corn and soybeans directly in the crosshairs.

Corn:

Traders on the Chicago Board of Trade turned notably bearish on corn earlier this week shifting into a net short position for the first time in nearly seven months. This pivot stems from favorable U.S. planting conditions, which are ahead of the five-year average, and USDA projections that estimate a 27% increase in U.S. corn supply for the 2025-26 marketing year.

Corn planting was 78% complete through Sunday, compared to 62% last week and 73% on average. Based on the individual state planting progress reports, an estimated 15.0 million acres of corn were planted last week. An estimated 74.4 million acres of corn have been planted so far with roughly 20.9 million acres of corn remaining to be planted based on the USDA's March 31 Prospective Plantings report estimate.

U.S. ethanol production climbed to 1.093 million barrels per day, a sign of strengthening demand.

Soybeans:

A 90-day trade truce between the U.S. and China has temporarily lifted tariffs on U.S. agricultural exports, including soybeans. However, this truce is set to end just before harvest, leaving trade uneasy about long-term trade stability.

Brazil's soybean crop estimate was trimmed by 2.4 million metric tons due to weather issues, particularly drought stress in central areas. The revised output of 171.6 MMT is still large but could tighten global supplies, especially if U.S. yields falter later in the season.

Soybean planting was reported at 66% complete nationally vs. 48% last week and 53% on average. Planting progress was the second fastest in the last ten years with an expected 15.1 million acres being planted last week.

Weekly Export Sales Recap:

- Corn sales within expectations

-Soybean sales at top of expectations

-New crop wheat sales higher than expected

-SBM sales at top of expectations and 15-week high/SBO sales as expected

U.S. corn sales, for the week ended 5/15/25, were 1.191 MMT (46.9 million bushels), within market expectations of 700k-1.6 MMT and while they were down from the previous two weeks' very strong sales of 66.0 and 65.4 mil bu, they continue to run at an elevated level, now having averaged 50.3 mil bu/week over the last 8 weeks vs last year's 31.4 mil bu/week average during the same period. More importantly, total commitments of 2.491 billion bushels are up 28% from last year vs the USDA's 2.600 billion bushel export projection reflecting an expected 13% increase from last year, while we see the level of sales currently on the books already being enough to allow the USDA's export projection to be reached when taking into account the estimated difference between official Census Bureau trade data and Export Sales data, which we see at around 175 million bushels (2023/24 difference was 155 mil bu), as the USDA's export target continues to look potentially notably too low (100+ mil bu?). This week's sales included 271k tonnes to Japan, 197k to Mexico and 125k to Colombia. New crop sales of 218k tonnes (8.6 mil bu) were within expectations of 50k-500k tonnes, bringing total sales for 25/26 to 117 mil bu vs new crop sales at this time last year of 103 mil bu.

U.S. soybean sales last week were 308k tonnes (11.3 mil bu), at the top of market expectations of 100k-300k tonnes, and maintaining a rather consistent pace of late, having averaged 12.2 mil bu/week over the last four weeks vs last year's 12.8 mil bu/week average during the same period. Total commitments of 1.775 billion bushels are up 13% from last year's 1.576 billion vs the USDA's 1.850 bil bu export projection reflecting an expected 9% increase from last year. In order to reach the USDA's export target, we estimate soybean sales will need to average roughly 4.5 mil bu/week through the end of August vs last year's 6.3 mil/week average from this point forward, keeping the USDA's estimate appearing good for now as sales are expected to run below year ago levels going forward. This week's sales were led by 135k tonnes to Mexico and 43k tonnes to unknown. New crop sales were minimal at 15k tonnes (0.6 mil bu) vs expectations of 90k-400k tonnes, with total new crop sales so far at just 38 mil bu vs 35 million last year and among the lowest level of new crop sales for mid-May in the last 20 years.

Livestock:

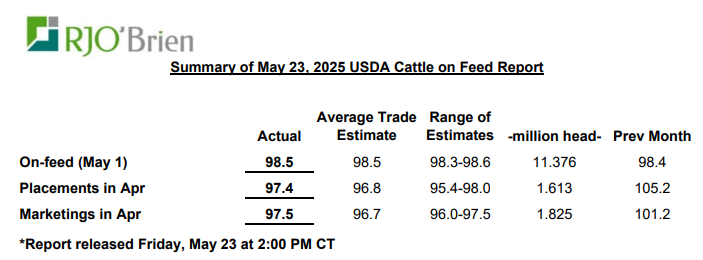

May 1 Cattle on feed as expected. April Placements higher than expected. April Marketings higher than expected.

Weather:

Forecasts are wetter in the western corn belt in the 1-5 day outlook, wetter in the Ohio Valley in the 6-10 day and wetter across central corn belt in the 11-15 day.

Yesterday’s drought monitor showed improvements in the upper Midwest, with still lingering problems in the southwest.

Economy:

The US House of Representatives passed President Trump's domestic policy package on Thursday. The multitrillion-dollar bill narrowly passed with a vote of 215-214. The legislation now moves to the Senate, where it faces significant challenges, as several Republican senators have indicated that major revisions will be required to secure their support. The Congressional Budget Office estimates that the bill will add about $3.8 trillion to the federal government's $36.2 trillion debt over the next 10 years. Investors are concerned that the bill will cause federal deficits to grow rapidly and hurt the country's long-term financial stability. The 30-year Treasury yield briefly rose to 5.17% on Thursday, its highest level in nearly 20 years. The bill includes a number of biofuel/45z items: Feedstocks from outside of North America would be eliminated. Also, the Indirect Land Use Change would be eliminated, opening the door for more soybean oil usage in biofuels. 45Z would also be extended through 2031 vs. 2027 previously.

Something That Probably Means Everything:

Man walks into a bar.

It’s the starting point for a million jokes. And for season after season on “Cheers,” some of the best of those were delivered by George Wendt, who died on Tuesday at age 76, as the long-suffering Norm Peterson.

Known above all, for his entrances, throwing open the door of the show’s namesake tavern, greeted with a hearty “Norm!” You could say that he was the character whom the show’s theme-song lyrics (“Sometimes you want to go where everybody knows your name”) were about.

The one-liners that the “Cheers” writing staff produced for him helped fill in the picture, a ritual call and response with the barkeeps. “What would you like, Norm?” “A reason to live. Keep ’em coming.” “What you up to, Norm?” “My ears.”

Quote of the Week:

“It’s a dog-eat-dog world, Sammy, and I’m wearing Milk-Bone underwear” – Norm Peterson, Cheers