5.30.25 Tredas Weekly Recap

Weekly Action:

July25 Corn down 16 at $4.4350

July25 Beans down 18.25 at $10.4225

July25 KC Wheat down 5.75 at $5.3225

June25 Hogs up $2.975 to $101.275

June25 Fats down $0.325 at $215.475

Aug25 Feeders down $1.70 at $298.675

Dec25 Corn down 11.5 at $4.3850

Nov25 Beans down 24 at $10.2675

Dec25 KC Wheat down 8.25 at $5.68

Grains:

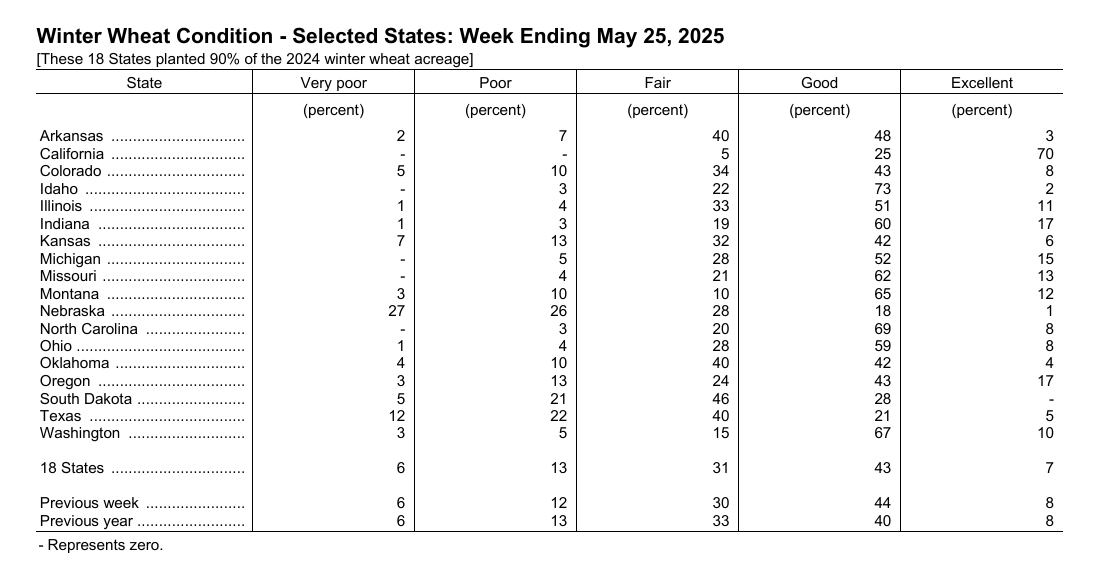

NASS released the first update of 2025 for US corn/spring wheat crop conditions Tuesday afternoon. The report stated that 68% of the US corn crop was in the good/excellent category, while just 45% of spring wheat was seen as good/excellent. Initial crop ratings report correlates poorly with final yield. Individually, Nebraska corn was rated 70% good/excellent, while just 3% was rated as very poor/poor. Iowa’s corn condition was rated at 83% good/excellent, the state’s highest in the last 10 years. Minnesota was tabbed at 69% good/excellent while Missouri came in at 76%, also a new record high. See the rest of the breakdown below:

December corn was pressured this week from favorable rains across the plains. Chart support sits at $4.35 followed by $4.28 lows. South American corn harvest is ramping up and is currently a discount to the US gulf price. On the technical side, corn is in neutral and heading toward the weak end of the range to close this week of trading.

Soybeans:

Soybeans continued their slide this week, partly due to a Truth Social post from US President Trump stating that China had “totally violated its agreement with us.” July soybeans fell 0.9% to ~$10.43 after the post was made. Soyoil futures also saw increased pressure this week, as data from the EIA showed that consumption of soyoil for biofuel production remains behind the pace of the year prior. For the month of March, soyoil consumption was 832 million pounds (down 19%) from March of 2024. Soyoil futures saw a 3.1% decline, which has also affected negative trade in soybean futures.

Livestock:

Cattle markets had a turbulent opening this week. Reports of screwworms being found in Missouri caused markets to trade lower on Tuesday, but the screwworm rumor had been found to be false later that day, creating a positive trade sentiment through the end of the week. The southern border is closed for cattle movement in an attempt to slow or prevent screwworm spreading to high-volume feeding areas. The impact may be substantial in a market clawing for all-time highs almost daily. Even in these high futures markets, basis values for cattle are as high as ever. Despite exposing cattle as a “nervous market” on Tuesday, some commentary sources continue to suggest that the futures are undervalued, stating that current cash bids could show the true value of where they believe cattle may settle.

Lean hog futures continue to trade in a defined range for delivery to July, but delivery in later months shows more strength in the futures market. August futures have shown a bullish run since the beginning of April, nearing contract highs in points of strength, with October and December markets following suit. Chinese tariff talk has been a factor in the pork cutout markets, and even with reduced tariffs, the tariff on pork products stands at 57% between the US and China (via Pork Checkoff). This could cause potential issues in pork processing markets where China, a massive consumer of US pork, reduces their purchasing of standard cuts. However, their demand for specialty cuts should remain relatively strong, and accompanied by low US demand, they could maintain some strength in export markets.

Weather:

Hydrological drought conditions have improved over the past few weeks, with heavier-than-anticipated precipitation coming through the plains and Midwest. Some areas have seen upwards of 5 inches of rain in the last 14 days, with some weather stations calling for more precipitation in the next 10 days. In the below image from the UNL drought monitor, the left map is from yesterday, May 27th and the map to the right is from May 13th. There have been significant improvements in some places, but most of Nebraska is still under some form of elevated drought risk.

As it stands, hydrological drought is not the end-all-be-all. Soil moisture is a key component of measuring crop drought and coming to conclusions about growing conditions. AG-WX provides a chart showing soil moisture to certain depths, and much of the corn belt has lower-than-normal soil moisture at critical depths for corn and soybean growth.

Upcoming precipitation forecasts provided by AgResource Commentary show that the outlook for precipitation in the Western Corn Belt is optimistic, showing anticipated rains in drier areas.

Economy:

Markets had a relatively quiet & positive week, with an announcement of pausing tariffs on the EU made by President Trump on Wednesday. This morning, investors had a moment of turmoil as Donald Trump posted on his social media platform, Truth Social, regarding China and the violations of the trade agreements that they have come to terms with. “So much for being Mr. NICE GUY!” ended his rant, and markets saw some staggering, but have since worked back to near-open levels on many indices. Trade negotiations with Beijing have been taking place for weeks now, and many sources have no end to these negotiations in sight. The timeline of these negotiations is still vague, with many hoping for a resolution before the beginning of harvest season.

The US Dollar index has been trading within a range of ~98-101% value for the past few weeks, which is significantly lower than early February, which marked some highs at 110%.

Something That Probably Means Nothing:

After filming the first season of the show “Friends,” producers of the show sent the cast to Las Vegas from New York for a trip in 1994. The production team stated to the soon to be superstars that this was going to be the last time any of the cast members would be able to take a vacation before becoming famous.

Since airing on September 22, 1994, Friends has established itself as one of the most popular TV shows of all time, sitting at the 29th most watched show ever, according to IMDb.

Quote of the Week:

Good leaders don't make excuses. Instead, they figure out a way to get things done. – Jocko Willink