6.6.25 Tredas Weekly Recap

Weekly Action:

July25 Corn down 1.5 at $4.42

July25 Beans up 15.75 to $10.58

July25 KC Wheat up 17.5 to $5.4975

June25 Hogs up $1.325 to $102.600

June25 Fats up $10.55 to $226.025

Aug25 Feeders up $11.325 to $310.000

Dec25 Corn up 10.75 to $4.4925

Nov25 Beans up 10.75 to $10.3750

Dec25 Cotton at $68.21

Sept25 Chicago Wheat at $5.7025

Dec26 Corn at $4.76

Nov26 Beans at $10.61

July26 KC Wheat at $6.22

July26 Chicago Wheat at $6.26

Grains:

Fairly steady trade this week in the grain markets with KC wheat leading the way 17c higher. Early Friday afternoon, President Trump stated that three U.S. trade representatives will be meeting with trade representatives from China on Monday, June 9th in London. Trade will be awaiting the news resulting of that meeting in hopes a trade deal will be made in coming days.

This chart shows the past 5, 15, and 30 years of historical patterns of December corn futures.

December corn has posted the high in May, June, or July in 14 out of the past 25 years.

From a technical aspect, December corn had a productive day closing above the 50- and 200-day moving average. The 100-day moving average is the next point of resistance sitting at $4.54. Historically, June presents a lot of volatility so making sure the integrity and vision are clear within your marketing plan to maximize opportunities when given. It is important to also understand how ARC/PLC elections along with ECO to understand work and if they have any value within your own marketing plan. ARC county has an effective $4.33 price floor with however many base acres are listed on each farm.

Current December corn chart. Today we closed above the 50 and 200 day (white and yellow line) moving average which is productive from a technical outlook.

As of Tuesday, funds sold another 53k contracts of corn (net short 154k) and 28k of soybeans (net long 8k).

Next Thursday, June 12th the USDA will be releasing June WASDE report. Below is a summary of the estimates provided by R.J. O’Brien’s, Randy Mittelstaedt.

Corn (2024/25)

Exports: Expected to be revised upward due to strong sales; analyst estimates 2.700 billion bushels vs USDA’s 2.600.

Ending Stocks: Could drop to 1.365 billion bushels if exports are raised by 50 million.

Ethanol: USDA’s 5.500-billion-bushel estimate is supported by current production pace.

Feed/Residual Use: Likely Overestimated; revision expected in July after the June 30 Grain Stocks report.

Corn (2025/26)

No major changes are expected except for carryover effects.

Ending stocks projected at 1.819 billion bushels, slightly above USDA’s May estimate.

Soybeans (2024/25)

Exports: May fall short of USDA’s 1.850 billion bushel estimate due to slowing shipment pace.

Crush: Strong April data supports USDA’s 2.420-billion-bushel estimate.

Ending Stocks: Estimated at 382 million bushels vs USDA’s 350 million.

Soybeans (2025/26)

Exports: Likely to be revised lower due to weak new crop sales and strong Brazilian competition.

Yield: Analyst uses 51.3 bu/acre vs USDA’s 52.5.

Ending Stocks: Estimated at 285 million bushels vs USDA’s 295 million.

Wheat (2024/25)

Exports: On track with USDA’s 820-million-bushel estimate.

Feed/Residual Use: Could be underestimated; analyst uses 150 million bushels vs USDA’s 120 million.

Ending Stocks: Estimated at 816 million bushels vs USDA’s 841 million.

Wheat (2025/26)

Production: Slightly lower winter wheat crop expected; spring wheat yield concerns noted.

Exports: Early sales strong; USDA may raise its 800-million-bushel estimate.

Ending Stocks: Estimated at 868 million bushels vs USDA’s 923 million.

Weather:

3 and 7 day forecast projecting more heavy rainfall in the delta region where they have received heavy precipitation the past two weeks.

Warmer than average temps are expected across all of the corn belt.

Extended forecasts have been consistent with projecting a ‘warmer than average’ summer.

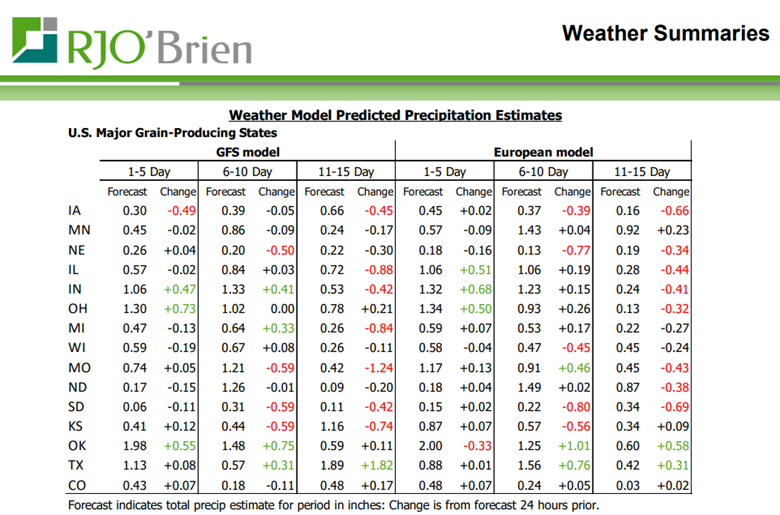

GFS and European model comparisons for the next 1-5, 6-10, and 11-15 day forecasts.

Economy:

(Reuters) Oil prices steadied on Friday and were on track for their first weekly gain in three weeks after President Donald Trump and Chinese leader Xi Jinping resumed trade talks, raising hopes for growth and stronger demand in the world's two largest economies. Canada also continued trade talks with the U.S., with Prime Minister Mark Carney in direct contact with Trump, according to Industry Minister Melanie Joly.

(Bloomberg) Donald Trump declared that Xi Jinping agreed to restore the flow of rare earth magnets after a 90-minute phone call. It’s less clear what Xi got in return, apart from putting a lid on further punitive US measures. One of the few clear takeaways appeared to be an assurance for the US to welcome Chinese students, a major issue in China but also not one that would explain why Xi got on the phone after making Trump wait for months.

Something That Probably Means Nothing:

Did you know that the average American consumes about 25 pounds of corn annually, but only a small fraction of that is directly from corn on the cob? Most of it comes from processed foods, sweeteners, and even beverages!

Quote of the Week:

“To do the impossible, you must be able to see the invisible.” - Lane Kiffin