8.15.25 Tredas Weekly Recap

Weekly Action:

Sep25 Corn up 1 to $3.8425

Sep25 Beans up 55.75 to $10.2275

Sep25 KC Wheat down 9.75 at $5.065

Sep25 Chi Wheat down 8.5 at $5.07

Dec25 Cotton up 154pts to $0.6754/lb

Oct25 Hogs down $0.425 at $90.125

Oct25 Fats up $4.653 to $230.60

Sep25 Feeders up $6.85 to $347.225

Dec25 Corn up 0.75 to $4.0575

Nov25 Beans up 55.25 to $10.4275

July26 KC Wheat down 4.5 at $5.69

July26 Chi Wheat down 12 at $5.66

Dec26 Cotton up 29pts at $0.6922/lb

Grains:

With the recent WASDE report on August 12th, the USDA revised yields and planted acres. With these changes, we saw an increase in not only the expected yield but also planted acres for corn. Stone X estimates were extremely close to the number that USDA came out with, showing a massive 188.8bu crop on 97.3M acres of land. Soybeans also saw a moderate increase in yield to 53.2, but their area planted shrunk by 2M acres.

Corn:

After the release of the USDA report on Tuesday, new crop corn had a sharp close, testing a new contract low at $3.92. This downturn was then followed by 3 subsequent positive days, closing at $4.0575 at the close of today’s session closing higher on the week. New crop exports have also stayed relatively high, with gulf basis values firm. High cost of freight is causing a lack of positive basis through the heartland, and basis values remain weak as we see them now.

Soybeans:

Soybeans had a great week, rallying nearly 60c off of recent lows made August 6th. At the end of the week, a close at $10.4275 shows strong support, breaking through points of resistance and settling above $10.40.

Summary of USDA August 12th Report

Randy Mittelstaedt with RJ O’Brien’s summary of USDA report - The USDA’s August 2025 report projects a record U.S. corn crop of 16.7 billion bushels, a 13% increase from 2024 and 1.4 billion bushels above the previous record set in 2023/24. This surge is driven by a record national average yield of 188.8 bushels per acre, up 9.5 bushels from last year. Key corn-producing states like Iowa, Illinois, Indiana, and Minnesota are expected to achieve record yields. The increase in production is supported by a 1.9-million-acre rise in harvested area. Despite a lower carry-in of 458 million bushels (down 26% from last year), total corn supply is projected to rise 8.5%. Demand is also expected to grow by 3.9%, with feed/residual use increasing by 425 million bushels (7.5%), and ethanol and export use each rising by 2%. However, the ending stocks for new crop corn are forecast at 2.117 billion bushels, a 62% increase from last year and the highest since 2019. This glut is expected to pressure prices, with the average farm price projected at $3.90 per bushel, down $0.40 from last year. The market reaction was bearish, with futures dipping below $4. Analysts had anticipated a smaller crop, and the USDA’s higher-than-expected yield surprised many. While the supply outlook is strong, the price outlook remains subdued due to the large surplus.

Soybean production is forecast at 4.29 billion bushels, down 2% from 2024, despite a record average yield of 53.6 bushels per acre, up 2.9 bushels from last year. The decline in production is attributed to a 7% reduction in planted acreage, down 6 million acres from 2024. States like Illinois, Indiana, and Iowa are expected to achieve record yields. Soybean demand is projected to fall by 1.2%, with exports dropping 9% (170 million bushels) due to trade disruptions with China. Despite lower demand, ending stocks for new crop soybeans are forecast at 290 million bushels, slightly down from July. The stocks-to-use ratio is projected at 6.7%, indicating tighter supplies for the second consecutive year. This tightening of stocks would typically support higher prices, but trade uncertainty is acting as a headwind. The USDA projects the average farm price at $10.10 per bushel, which reflects cautious optimism amid global market volatility.

The August USDA reports paint a picture of abundant corn supply with bearish price implications, while soybeans face a more nuanced outlook—record yields offset by reduced acreage and export challenges. Farmers and market participants will need to closely monitor September’s in-field measurements and global trade developments, especially with China, to refine expectations for the 2025/26 marketing year.

Livestock:

Cattle markets finished the week higher following a press conference between Texas Gov. Greg Abbott and Secretary of Agriculture Brooke Rollins regarding the new world screwworm. During this conference, it was revealed that the US is investing heavily into the production of sterile screwworm larvae, building a plant 20 miles from the US/Mexico border. This planned plant will have the capacity to produce 300M screwworm larvae per week, according to Rollins. Along with this, the USDA is also ushering in a new way to trap/eradicate the screwworm with traps and attractants. The implementation of these traps is yet to be seen. The border remains closed until further notice.

Lean hog futures ended the week slightly lower after positive trade today. Vietnamese producers are currently battling with a bout of African Swine Fever, and there is an estimated 100k head affected currently.

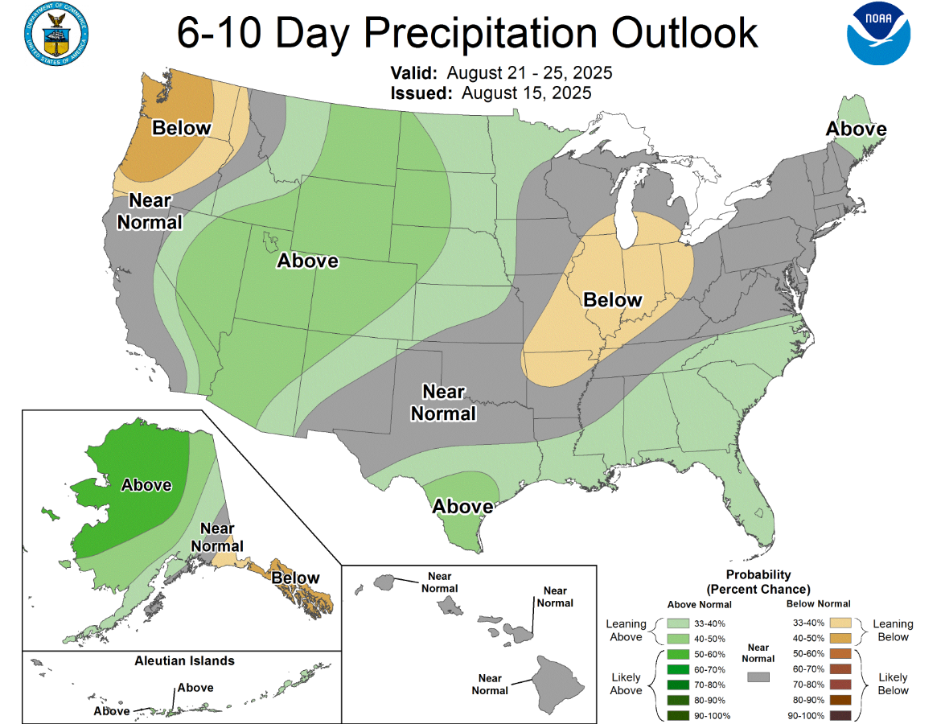

Weather:

Economy:

Wholesale prices rose far more than expected in July, providing a potential sign that inflation is still a threat to the U.S. economy, a Bureau of Labor Statistics report Thursday showed.

The producer price index, which measures final demand goods and services prices, jumped 0.9% on the month, compared with the Dow Jones estimate for a 0.2% gain. It was the biggest monthly increase since June 2022.

Excluding food and energy prices, core PPI rose 0.9% against the forecast for 0.3%. Excluding food, energy and trade services, the index was up 0.6%, the biggest gain since March 2022.

On an annual basis, headline PPI increased 3.3%, the biggest 12-month move since February and well above the Federal Reserve’s 2% inflation target.

Services inflation provided much of the push higher, rising 1.1% in July for the largest gain also since March 2022. Trade services margins climbed 2%, coming amid ongoing developments in President Donald Trump’s tariff implementations.

In addition, 30% of the increase in services came from a 3.8% rise in machinery and equipment wholesaling. Also, portfolio management fees surged 5.4% and airline passenger services prices climbed 1%.

Something That Probably Means Nothing:

Pro Farmer Crop Tour kicks off next week.

Monday – OH & SD.

Tuesday – IN & NE

Wednesday – W. IA & IL

Thursday – IA & MN

Quote of the Week:

“It’s not about the outcome, it’s about the process.” - Matt Rhule