8.8.25 Tredas Weekly Recap

Weekly Action:

Sep25 Corn down 6.5 to $3.8325

Sep25 Beans down 1.5 to $9.67

Sep25 KC Wheat down 2.5 to $5.1625

Sep25 Chi Wheat down 1.25 to $5.155

Dec25 Cotton up 24 points at $0.6660/lb

Oct25 Hogs down $1.00 at $90.55

Oct25 Fats up $2.425 to $225.95

Sep25 Feeders up $6.725 to $340.375

Dec25 Corn down 5 to $4.06

Nov25 Beans down 1.5 to $9.865

July26 KC Wheat down 5 to $5.7475

July26 Chi Wheat up 1 at $4.7625

Dec26 Cotton up 46 points at $0.6893/lb

Grains:

Grains have had a turbulent week, with corn having the first 3 sessions trade lower, finding support, and finishing the week off new contract lows. Soybeans traded between a range of $10.00 and $9.81, testing support below the previous trading range dating back to early March. New-crop corn exports for the 25/26 crop year have far outpaced the average yearly rate, tabbing 124.5Mbu sold this week & bringing the total amount sold to 464Mbu. That being said, exports will have to be high to deal with the growing carryout.

Corn:

December corn decided to put in a new contract low this week, rifling down to $3.9675/bu. Positive corn belt weather, paired with the expectation of a massive crop, has continued downward-trending trade patterns. FC Stone has released yield expectations for the 25/26 crop year at 188.1bu. After making this new low, we had a bounce towards $4.10 and met resistance this afternoon. The upcoming WASDE on August 12th will have revised yield projections based on NASS surveys.

Soybeans:

Soybeans traded in a relatively tight range for the week. Early in the week, markets were trying to find some fuel for a rally, but fell short on favorable weather, a lack of exports, and a lack of rally-worthy news. FC Stone’s prediction for bean production was high as well, estimating 53.6bu for 25/26. The seasonal timeframe for soybeans has not been concluded, and there are still many weeks until combines start to hit bean fields.

Livestock:

Live cattle futures had quite the week, reclaiming losses from last week and making new highs, then having a sharp correction downwards to end trade on Friday. October live cattle fell $6.275, and deferred months saw less-exaggerated movements. This was possibly started by cash trading in the north slightly lower than last week when higher trade was anticipated. Feeder cattle had a similar week, clawing back to create new highs that were sharply rejected during today’s trading session. Every contract currently trading, except for August 2026, was locked limit-down today at end of trade.

Lean hog futures traded higher early in the week and turned lower come Wednesday on contracts out to December delivery. We have seen a counter-seasonal rally in the past few months when it comes to hog trading, and time will tell if this market continues to appreciate into the winter months or find some sort of correction, whether that be at previous highs or new bounds.

Weather:

Grain-growing weather appears to remain favorable throughout the coming weeks. Temperatures are slightly higher than normal, which could accelerate crop progression prematurely. While timely rain has been a key factor this growing season, dry, sunny weather is another key to getting plants to maturity and filling out ears & pods.

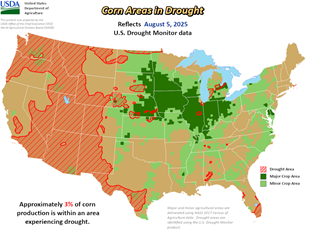

Hydrological drought is near-nonexistent in corn/bean growing areas as of today. The release of this week’s drought monitor shows that there is now only about 3% of corn and soybean production in drought.

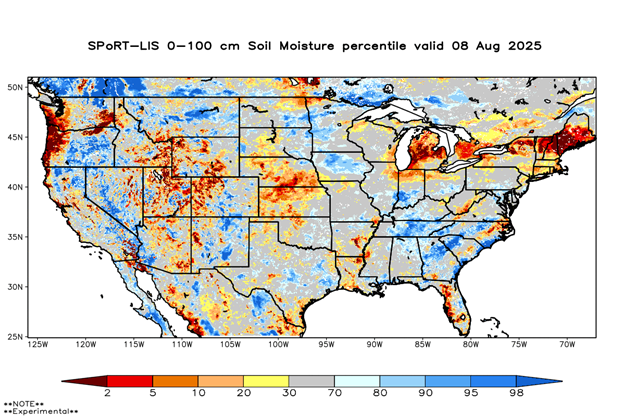

Subsoil moisture content throughout much of the corn belt is lacking still, however. Much of the western plains and eastern corn belt has below average moisture at 40in (ag-wx).

Economy:

U.S. Commerce Secretary Howard Lutnick stated that he expects the current trade negotiation deadline with China to be extended by another 90 days, signaling a potential pause in escalating tensions. He also emphasized that American tech companies manufacturing semiconductors domestically would be exempt from tariffs, reinforcing the administration’s strategy of using tariff incentives to promote onshore production. The remarks reflect a broader effort to balance trade pressure on China with industrial policy aimed at strengthening U.S. technological self-sufficiency.

Home sellers beware, as this week marks an all-time high when looking at the number of home sellers compared to home buyers. According to Barchart, U.S. home sellers outnumber the homebuyers by more than 500,000. In other news, student loan delinquency has also reached all-time highs, with 12.9% of borrowers becoming delinquent. This is a stark increase from the sub-1% numbers seen in Q4 of 2024.

Something That Probably Means Nothing:

In the northern hemisphere, August is typically referred to as “meteor month” by observers and astronomers, due to an annual event known as the Perseid meteor shower. This year, however, a full moon on August 9th, followed by subsequent nights of waning gibbous phases, means that extra light in the sky may wash out the effect of a beloved-by-many annual cosmic events. August 11th & 12th are the projected dates for this event, so if you have nothing going on, it might be worth staring into the sky.

Quote of the Week:

Morale is the key to everything. There is nothing wrong with keeping people happy—Robert O’Neill

Have a great weekend!