9.5.25 Tredas Weekly Recap

Weekly Action:

Dec25 Corn down 2 to $4.18

Nov25 Beans down 27 to $10.27

Dec25 KC Wheat down 14 at $5.05

Dec25 Chi Wheat down 15 at $5.19

Dec25 Cotton down 51pts to $0.6603/lb

Oct25 Hogs up $1.025 to $96.02

Oct25 Fats down $3.675 to $235.97

Sep25 Feeders down $4.95 to $359.82

Dec26 Corn unch to $4.5875

Nov26 Beans down 13 to $10.70

Grains:

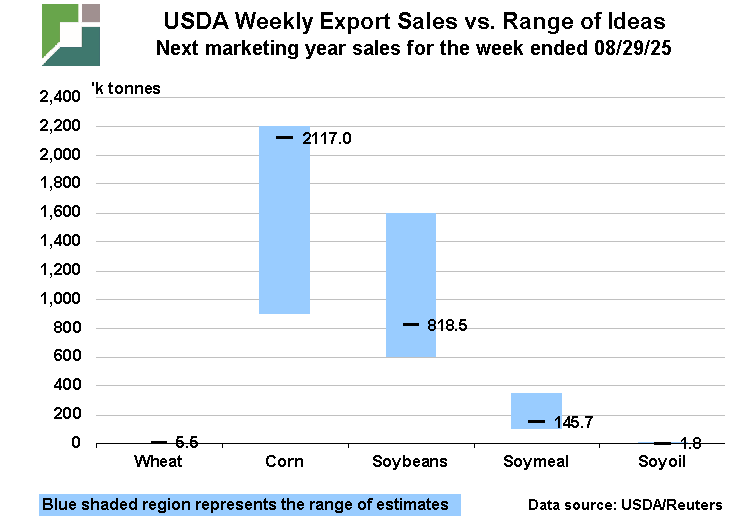

Weekly export sales released this morning showed new crop export sales for corn at the top of the range of estimates again while soybeans and wheat were near the bottom of their ranges. Over the last week the US sold 75.6 million bushels of corn, 27.2 million bushels of beans, and 183,00 bushels of wheat for export for the 25/26 crop year. Argentine corn offers have become cheaper than US Fob values and Ukraine corn basis is weakening which adds to world competition for demand. China continues to avoid US soybean purchases as the trade war negotiations drag on. South America is planting it’s next crop so the longer the negotiations take the smaller the window will be for US sales to China this crop year.

StoneX yesterday released their updated estimates for this year’s corn and soybean production. Their new corn yield is 186.9 (188.1 bu previously) with a total production of 16.57 billion bushels and their new soybean yield is 53.2 bushels for a total production of 4.26 billion bushels. The USDA corn yield in the August report was 188.8 bu with a total production of 16.7 billion bushels with the soybean yield at 53.6 bu and a total production of 4.29 billion bushels. The next USDA report will be next Friday September 12th and traders will be watching for any changes in production estimates to see if the late season dryness has had an impact as we head into harvest.

Chicago and KC wheat futures fell to new contract lows this week as world exporters compete for demand. Dec Chicago reached $5.145 and Dec KC fell to $5.0175 with Chicago showing an unusual premium to KC futures. Russian export values have reached $215-220/ Metric Ton which is a test of last year’s lows. World feed wheat offers are now at the same price as US Gulf corn offers at $207-209/MT. Fewer animals and abundant supply will keep pressure on feed grain prices into next year.

December soyoil futures filled the June chart gap left after the RVO announcement and a close below $0.51 will turn the price trend bearish with the next chart support at $0.49. The EPA has not announced any reallocation of SRE’s from 2 weeks ago and crude oil futures have turned lower the last 3 days which could add downside pressure to the whole energy complex.

US corn conditions were rated 69% good to excellent nationally on Tuesday which was a 2% decline from the week prior. Last year’s ratings were 65% at this time and the current ratings are the best in 9 years for late Aug/early Sep. Soybean conditions declined 4% from last week to 65% good to excellent which is the same as last year at this time and the best in 7 years for late Aug/early Sep. Spring wheat harvest is 72% complete vs 53% last week and 71% average.

Weather:

The Western Corn Belt received good rains last weekend with additional scattered showers in the forecast. The Eastern Corn Belt maintains a mostly dry forecast in the north, while S. Illinois, Tennessee, Kentucky, into Ohio will see rain this weekend.

Temps remain seasonably cool with some warming in the 10 day forecast.

Economy:

The nonfarm payrolls released this morning increased by just 22,000 for the moth which was lower than the 75,000 that was forecasted. The report showed a slowdown from the July increase of 79,000 which was revised higher by 6,000. The unemployment rate also rose to 4.3%. The weakness in the jobs report add to recent signs of a weakening labor market and likely allows the Federal Reserve to cut interest rates later this month.

Mortgage rates saw the biggest one day drop on over a year today with the average rate on the 30 year fixed mortgage dropping 16 basis points to 6.29%.The 30 year fixed rate peaked in May at 7.08%. This drop in rates was a direct result of the weaker jobs report. Some analyst argue that buyers still need to see mortgage rates in the 5% range before it really makes a difference as home prices remain stubbornly high, with the median home price sitting near $450,000 in August.

Something That Probably Means Nothing:

Powerball’s jackpot has climbed to 1.8 billion ahead of the next drawing Saturday night. No one has won since May, making this the third largest jackpot in US history. The last jackpot over $1 billion was claimed in April 2024. The odds of winning with all six numbers including the red Powerball are 1 in 292,201,338. If you live in Nebraska and take the 30-year annuity you would receive $1,066,889,400 after taxes or $489,271,780 if you take the lump sum payment.

Quote of the Week:

Behind every successful rancher is a wife who works in town.