9.12.25 Tredas Weekly Recap

Weekly Action:

Dec25 Corn up 10 to $4.28

Nov25 Beans up 18.25 to $10.45

Dec25 KC Wheat up 8 at $5.13

Dec25 Cotton up 74pts to $0.6677/lb

Oct25 Hogs up $1.100 to $97.125

Oct25 Fats down $6.000 to $229.975

Sep25 Feeders down $9.425 to $350.400

Dec26 Corn up 9 to $4.67

Nov26 Beans up 11 to $10.81

July26 KC Wheat up 8 at $5.60

Dec26 Cotton up 50pts at $0.6938/lb

Grains:

USDA 9/12/25 Report Recap:

New Crop Corn:

Increased planted acres 1.4mil acres (97.3 Aug vs 98.7 Sept)

Increased harvested acres 1.3mil acres

Decreased yield 2.1bu (188.8 Aug vs 186.7 Sept)

Exports increased 100mil bu

Overall ending stocks decreased 7mil bu to 2.110bil bu

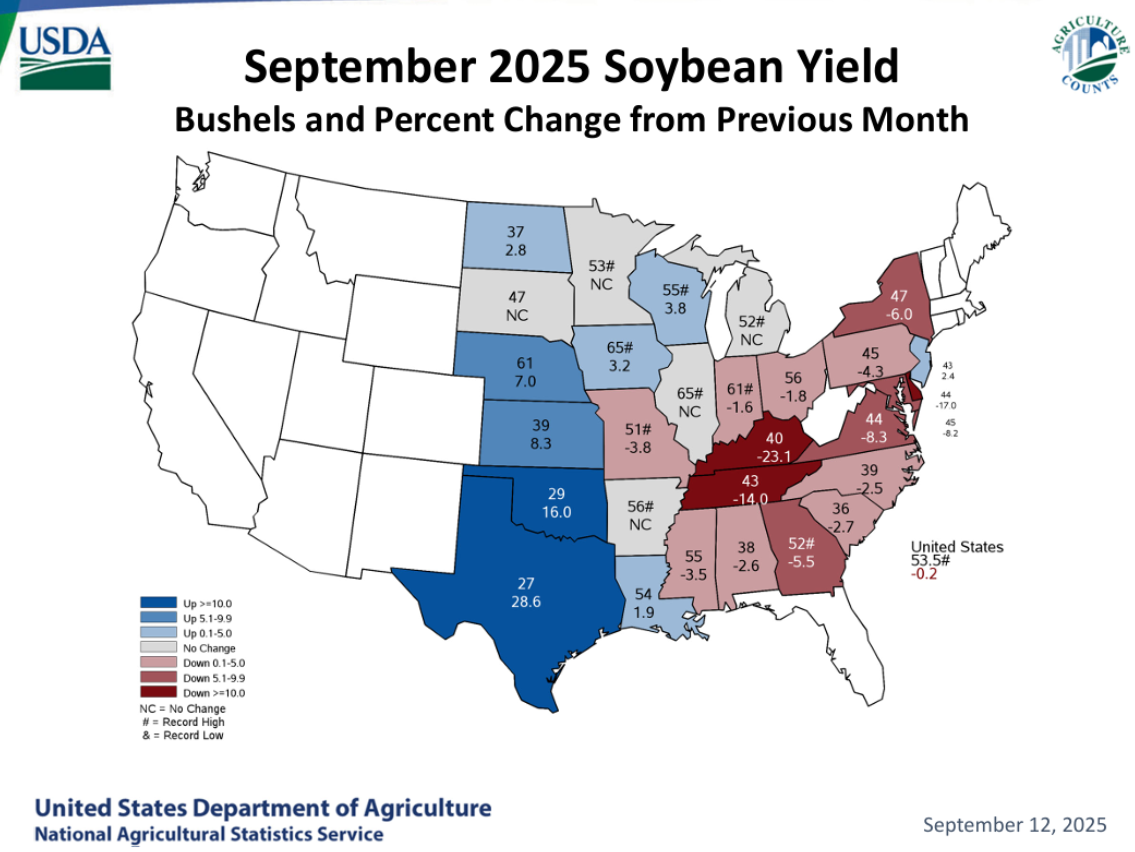

New Crop Soybeans:

Increased planted acres 200k acres (80.9 Aug vs 81.1 Sept)

Increased harvested acres 200k

Decreased yield .1 bu (53.6 Aug vs 53.5 Sept)

Decreased exports 20mil bu

Overall ending stocks increased 10 mil bu to 300mil

USDA Weekly Grain Export Sales Recap:

Corn sales much lower than expected

Soybean sales at bottom of expectations

Wheat sales at bottom of expectations

Livestock:

Cattle futures cooled this week off the backs of a poor jobs report and comments from Trump about high beef/grocery prices.

Cash activity so far this week has been $238-240 in the North, down $2-5 from last week, with Southern deals at $238.

The CME Feeder Cattle Index was down $1.99 at $363.48 on September 10.

Weather:

1-5 day risk slightly drier in the E. Midwest

6-10 day risks drier in the N. Midwest and Plains

11-15 day risks drier in the S. Plains and wetter in the C. Midwest

6-10 day cooler Midwest; 11-15 day warmer E. Midwest, cooler NW Midwest

Economy:

The labor market created far fewer jobs than previously thought, according to a Labor Department report Tuesday that added to concerns both about the health of the economy and the state of data collection. Annual revisions to nonfarm payrolls data for the year prior to March 2025 showed a drop of 911,000 from the initial estimates, according to a preliminary report from the Bureau of Labor Statistics. The largest markdowns came in leisure and hospitality (-176,000), professional and business services (-158,000) and retail trade (-126,200). Most sectors saw downward revisions, though transportation and warehousing and utilities had small gains. Almost all the revisions were confined to the private sector; government jobs were adjusted down by 31,000.

Prices consumers pay for a variety of goods and services moved higher than expected in August while jobless claims accelerated, providing challenging economic signals for the Federal Reserve before its meeting next week.

The consumer price index posted a seasonally adjusted 0.4% increase for the month, the biggest gain since January, putting the annual inflation rate at 2.9%, up 0.2 percentage point from the prior month and the highest reading since January. Economists surveyed by Dow Jones had been looking for respective readings of 0.3% and 2.9%.

For the vital core reading that excludes food and energy, the August gain was 0.3%, putting the 12-month figure at 3.1%, both as forecast. Fed officials consider core to be a better gauge of long-run trends. The central bank’s inflation target is 2%.

Something That Probably Means Nothing:

On top of the Huskers hanging nearly 70 points on the Akron Zips last Saturday, Husker fans hit the concessions stands hard, as the home opener was the first to permit alcohol sales.

In total, 38,782 cans of beer were sold in the stadium during the game, among nearly 165,000 total concessions items.

For comparison, UNL said that’s about 48,000 more than what was sold at last year’s game against the Colorado Buffaloes.

Quote of the Week:

Never Forget – America (9-11-2001)