11.21.25 Tredas Weekly Recap

Weekly Action:

Dec25 Corn down 4.5 at $4.2575

Jan26 Beans up 2 to $11.265

Dec25 Chi Wheat up 2.5 to $5.2975

Dec25 KC Wheat down 2.25 at $5.13

Dec25 Cotton down 114 points at $0.6135/lb

Dec25 Hogs down $0.85 at $77.65

Dec25 Fats down $4.9 at $214.25

Jan26 Feeders down $6.25 at $314.3

Dec26 Corn down 6.5 at $4.6075

Nov26 Beans down 2 at $11.13

July26 Chi Wheat down 32.75 at $5.2975

July26 KC Wheat down 4 at $5.525

Dec26 Cotton up 1 point to $0.6759/lb

Grains:

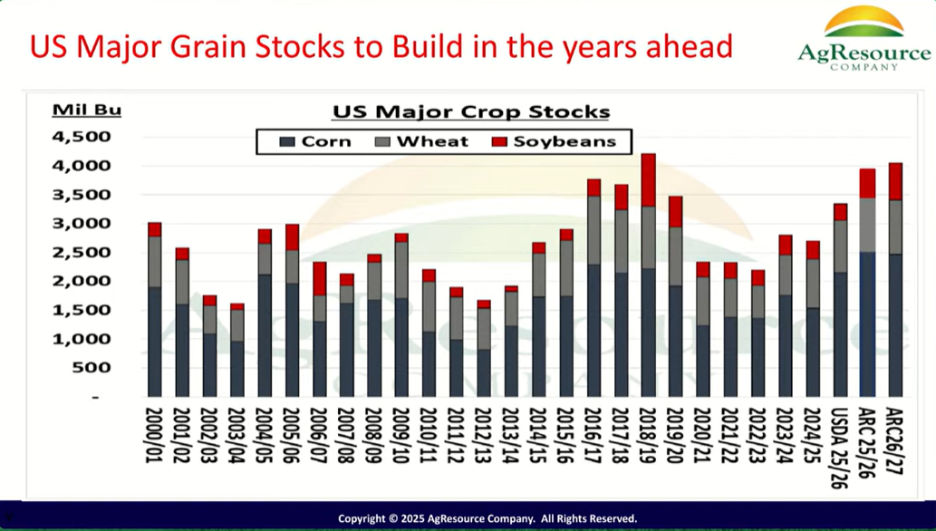

March Corn had a negative week and a neutral Friday close, bouncing off the 100 day moving average at 4.36 and closing at 4.38. Corn turned lower Wednesday as President Trump had some negative rhetoric on biofuels. US ethanol production is down 2% from last year while gasoline consumption is up 1% year over year. Export demand has been strong as weekly exports were above the high range of expectations. Exports are crucial as US and global stocks look to grow.

The US farmer is in a dilemma, as current inventory is valued below the cost of production for nearly 50% of farmers. Looking forward to 2026, corn and bean prices are thinly profitable for your equity farms and nonprofitable for the majority. This is not a sales pitch, but with expected losses over $40 billion for the 25/26 crop year, plan creation of your marketing goals are as crucial as ever.

Soybeans whipsawed Monday and gained back all their past weeks’ losses and some, but then moved into a “buy the rumor, sell the fact” trade. China purchased another slew of US Bean cargoes as January futures closed the week 43 cents off the weekly high. Technical indicators have turned bearish as Traders have their eyes on the October 27th gap down at 10.63 futures and will need new bullish news to fuel additional length. As of Friday, China has purchased 2.7 million tonnes of the 12 million tonne commitment. Flash sales are needed.

Livestock:

Cattle markets continue their volatile range as the current trend is lower. Cash trade has been well off week over week. The tariff exemption for Argentina beef started Friday off at a limit lower open for Feeder cattle and $5 lower for live. Both closing well off the lows going into a COF report. Calling this slightly friendly specific to placements.

Weather:

Central US weather trends get wetter into December. Drought concerns across the grain belt are minimal outside of Northern IL and a small area in Western NE.

South American weather has been too wet and much needed drying weather for Southern Brazil comes over the next 10 days. The La Nina-based forecast for South America has been incorrect and has no threatening weather trends to date. Private yield projects for the 25/26 corn crop are record as the Argentine corn crop is rated at 79% good to excellent compared to 26% a year ago.

Economy:

The US economy continues to chug along in lackluster fashion. The delayed September jobs report beat expectations but were led by a large number of Government layoffs coming back into the workforce. U-3 unemployment sits at a 47 month high of 4.4% with U-6 unemployment up at 8%.

Within your 401K there is a provision allowing you to make withdrawals if you can prove hardships. In 2025, 401K withdrawals hit a record high. Oddly enough, the stock market has hit multiple record highs prior peek in November.

Something That Probably Means Nothing:

Koalas have fingerprints: A koala's fingerprints are so similar to human ones that they could be confused at a crime scene.

Quote of the Week:

Don't watch the clock; do what it does. Keep going. - Sam Levenson