11.28.25 Tredas Weekly Recap

Weekly Action:

Mar26 Corn up 10 to $4.4775

Jan26 Beans up 10.75 to $11.3725

Mar26 Chi Wheat down 1.25 at $5.385

Mar26 KC Wheat up 0.25 to $5.28

Mar26 Cotton up 88 points to $0.6473/lb

Dec25 Hogs up $2.8 to $80.45

Dec25 Fats up $1.05 to $215.3

Jan26 Feeders up $8.75 to $323.05

Dec26 Corn up 7.5 to $4.6825

Nov26 Beans up 13.75 to $11.2675

July26 Chi Wheat down 4.5 at $5.5525

July26 KC Wheat down 1 at $5.515

Dec26 Cotton up 56 points to $0.6815/lb

Grains:

Short trade this week with the Thanksgiving holiday. The USDA released export sales data for the week ending October 16, 2025, as part of an expedited schedule to catch up on delayed reports. Corn export sales were exceptionally strong at 2.823 million metric tons (MMT), surpassing expectations of 1.4–2.5 MMT. This brought total corn commitments for the 2025/26 marketing year to 1.321 billion bushels, significantly higher than last year’s 924 million and representing 43% of the USDA’s annual export projection of 3.075 billion bushels. Mexico accounted for the largest share of corn sales at 1.718 MMT.

Soybean export sales reached 1.108 MMT, within the expected range of 600k–2.0 MMT. However, total soybean commitments stood at 540 million bushels, the lowest mid-October level in 17 years and only 33% of the annual projection of 1.635 billion bushels. Major buyers included the EU (255k tonnes) and Bangladesh (236k tonnes).

Wheat sales were 341k tonnes, at the bottom of expectations (350k–650k tonnes), but total commitments of 581 million bushels marked the highest mid-October level in nine years, representing 64.5% of the annual projection of 900 million bushels.

Soybean meal sales were phenomenal at 543k tonnes, exceeding expectations of 150k–450k tonnes. Commitments reached 5.695 MMT, the highest in 11 years, equating to 32.7% of the annual projection of 19.2 million tons. Soybean oil (SBO) sales were 19.1k tonnes, near the top of expectations (5k–25k tonnes), with commitments at 132k tonnes, up from 109k last year.

Overall, corn and soybean meal sales were notably strong, wheat showed steady growth, while soybeans lagged significantly compared to historical norms. USDA will continue releasing catch-up reports through year-end, with comprehensive totals expected on January 2, 2026.

Seasonally grains present opportunities going into the spring - having emphasis around making sure one is positioned properly going into the January crop report will be important going forward. Nebraska bean basis values have weakened in the past week with processors fading ~25c.

Weather:

The Climate Prediction Center released that La Niña is favored to continue into the Northern Hemisphere winter, with a transition to El Niño-neutral most likely in January-March 2026 (61% chance).

Winter/Spring: Potential for cooler, drier conditions early in the season.

Summer Outlook: Neutral El Niño/Southern Oscillation means greater uncertainty, but historical trends suggest variable precipitation and temperature swings.

Economy:

(Bloomberg) OPEC+ gathers this weekend for what will likely be a last review of global oil markets before the start of a turbulent year. Forecasters see a significant surplus in 2026 as new supply from the Americas continues to exceed demand growth. The International Energy Agency anticipates a record glut, while JPMorgan Chase & Co. sees prices falling toward $50 a barrel. The producers probably won’t make any changes to that path on Sunday, according to several OPEC+ delegates. In fact, some say the main item left to discuss is the organization’s long-term review of members’ production capacity.

(Reuters) Online sales in the U.S. on the Thanksgiving holiday are expected to rise 6% compared with last year to reach $8.6 billion, data from Salesforce showed on Thursday, suggesting shoppers were lapping up steep discounts from retailers to splurge amid tariff-induced macroeconomic uncertainty. As of 2 p.m. ET (1900 GMT), Thanksgiving spending in the U.S. was 5.8% higher than at the same time last year, reaching $2.6 billion, the data showed.

Something That Probably Means Nothing:

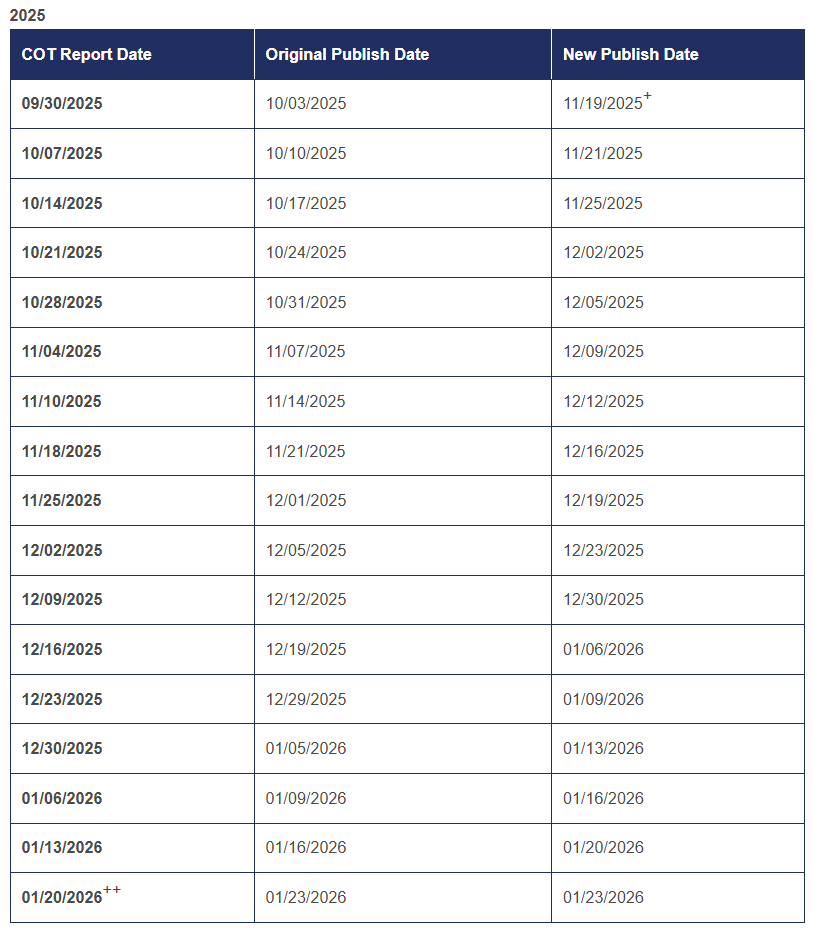

CFTC Commitment of Traders Reports started this past week, and the data will not be current until January 23, 2026.

Quote of the Week:

“Success is the sum of small efforts, repeated day in and day out.” – Robert Collier