12.19.25 Tredas Weekly Recap

Weekly Action:

Mar26 Corn up 12.25 to $4.4375

Jan26 Beans down 27.5 at $10.4925

Mar26 Chi Wheat down 39.25 at $5.0975

Mar26 KC Wheat down 2.75 at $5.1525

Mar26 Cotton down 8 points at $0.6375/lb

Feb26 Hogs down $1.535 at $82.99

Feb26 Fats up $0.775 to $230.4

Jan26 Feeders up $6.5 to $345.6

Dec26 Corn unchanged at $4.62

Nov26 Beans down 20.25 at $10.6775

July26 Chi Wheat down 14.25 at $5.3175

July26 KC Wheat down 2.5 at $5.41

Dec26 Cotton down 23 points at $0.673/lb

Grains:

Corn started the week off slow, where Monday and Tuesday’s trade sessions struggled to find positive trade. However, Wednesday and Thursday traders brought March futures back above $4.40/bu. Corn futures have yet to break the rangebound trading cycle that has plagued the contract since early October. The upcoming January stocks report will see a potential revision to the USDA’s optimistic 186bpa national yield. Along with this report comes a seasonal tendency for volatile trade in the corn market. Before

Soybeans have been put through the ringer this week. We have traded back to the upper 1/3 of the range we have traded all year prior to the breakout rally due to China demand. Indicators are buried in weakness, and we are waiting to see a chart correction. So far, China is ahead of pace with their purchase commitment of 12MMT (440Mbu) through the marketing year, but other demand is still lacking. Since playing catch-up on COT reports, funds were near record long in the bean market at the recent highs. That length has since diminished, placing us back to where we started.

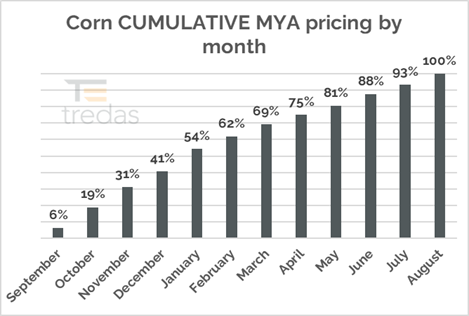

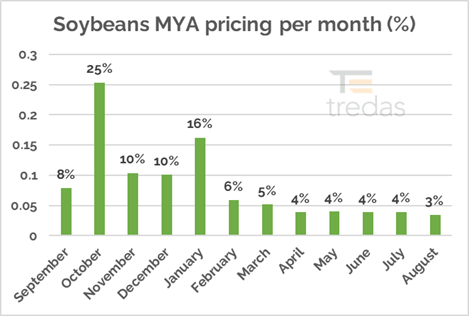

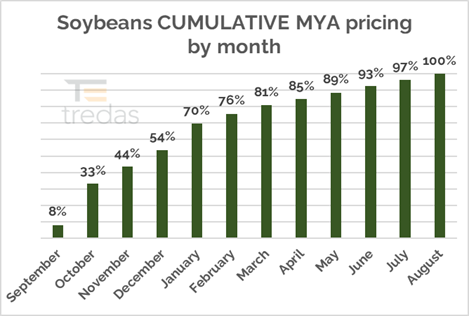

ARC/PLC Sidenote: At the close on Friday, we are currently ~36% priced on corn ARC/PLC for the marketing year average (MYA). This number will reach 41% by the end of the calendar year. As for beans, ARC/PLC pricing is ~48% completed and will reach 53% by the end of 2025. Despite rallying off the harvest lows, we are still below our threshold for the 5-year Olympic pricing average and will continue to be as long as the average price does not exceed ~$11-$11.20 through the rest of the MYA.

Livestock:

Fat and feeder futures cattle both held steady this week, with a good spurt of strength towards the end of Friday’s trade session. There are currently 2 chart gaps in cattle charts, one near the all-time highs, and one slightly above our current trading range. With the velocity of the last rallying move, it appears the lower of the 2 gaps ($233-$232 in Feb fats, $348-$345 in Jan feeders) is acting as a point of resistance before going to re-test contract highs.

Lean hog futures are continuing an upward-trend trading pattern, following their seasonal tendencies to rally into early spring. Indicators show the February contract as oversold, and there is currently ~$8 of carry to the May contract.

Economy:

The Bureau of Labor Statistics released a report of delayed jobs data for the last 2 months on Tuesday. In this report, it showed that the US lost 105k jobs in Oct and gained 64k in Nov. Most of the job additions were in health care and social services, as these two industries have been showing steady growth.

The Consumer Price Index released this week showed slowing inflation. All-item and core (less food and fuel) consumer price indexes rose 0.2% in the last 2 months. Wall Street had anticipated a 3.1% increase for FY2025, but at a 2.7% annual rate caused a green day during Thursday’s trading session.

Something That Probably Means Nothing:

Nebraska Quarterback Dylan Raiola plans on entering the transfer portal, according to ESPN insider Pete Thamel. The true sophomore quarterback accrued 2,000 yards of total offense this season, including 181/250 passing for 18 touchdowns and 6 interceptions in 9 games in 2025. According to On3, the popular college athletics recruiting site, Raiola is rated as the #4 QB in this off-season’s transfer portal rankings.

Quote of the Week:

“… there’s a lot of great QBs out there and a lot of guys want to play at Nebraska” – Huskers HC Matt Rhule