9.19.25 Tredas Weekly Recap

Weekly Action:

Dec25 Corn down 4 at $4.24

Nov25 Beans down 20.75 at $10.245

Dec25 Chi Wheat up 0.5 to $5.2225

Dec25 KC Wheat down 5.5 at $5.0775

Dec25 Cotton down 54 points at $0.6629/lb

Oct25 Hogs up $0.9 to $97.975

Oct25 Fats up $3.6 to $233.575

Nov25 Feeders up $7.75 to $350.925

Dec26 Corn down 5.75 at $4.62

Nov26 Beans down 10.75 at $10.7025

July26 Chi Wheat up 1.75 to $5.62

July26 KC Wheat down 2.75 at $5.5725

Dec26 Cotton down 9 points at $0.6935/lb

Grains:

Corn & soybean markets finished lower on the week despite pushing through resistance levels last Friday. Corn futures closed relatively flat on the day, whereas beans plunged into the afternoon, finishing down 11.5cts.

Corn harvest has kicked off in parts of the corn belt, with preliminary yield reports showing large variances versus what was expected. According to StoneX yield reports, Iowa farms have yielded either side of APH for the most part, with large variances (up to 25%) in spots. Time will tell where the final numbers end up, but the USDA still has national yield pegged at 186.7bu.

Soybean traders were holding out hope for news regarding a Chinese trade deal following a phone call between President Trump and Chinese President Xi Jinping. Trade talks between the two countries were held earlier this week in Europe, and after the first day Trump had announced that a deal would be struck for an “app that many young people love” (TikTok). Trump later posted via Truth Social, stating he would be meeting the Chinese president at APEC Summit in South Korea, as well as a soft-scheduled country visit at the beginning of next year. China has fulfilled their soybean needs from Brazil/Argentenia through the end of November.

Livestock:

Following two weeks of negative trade, the cattle complex was modestly higher leading up to the September Cattle on Feed Report this afternoon. The report showed values in line with expectations, headlined by cattle and calves on feed for the slaughter market. They came in at 11.1m head, down 1% from a year ago. Below is a graph comparing 2024 numbers vs. 2025 thus far.

Placements in feedlots were 1.78m head, down 10% from 2024. Marketings of fed cattle for the month of August came in at 1.57m head, 14% below 2024, notching the lowest mark for August marketings since the reports began in 1996.

Weather:

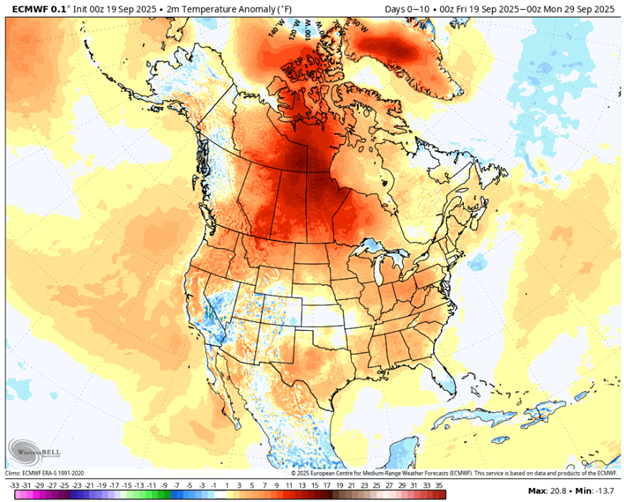

Weather forecasts continue to be neutral/non-threatening for markets through the end of the month. Cool temperatures with spotty precipitation forecasted for parts of the corn belt. While some are welcoming rains to finish out soybeans, others are hoping for clear skies to allow harvest to progress.

Economy:

For the first time in months, the Federal Reserve cut interest rates 25 basis points this week. Mortgage rates have reached a new recent low of 6.26%, down 9 basis points from last week according to Freddie Mac. Despite the cut to interest rates, continual revisions to job reports may show a slowing domestic economy.

Major stock indices continued to climb this week, reaching new highs after the Fed rate cut announcement. The US Dollar Index has marked a new recent low, marking $0.96218 on Wednesday. Historically, when the Fed cuts interest rates within 2% of all-time highs in the stock market, the S&P 500 has finished higher over the trailing 12 months 20 out of 20 times, an astonishing 100% hit rate.

Something That Means Everything:

Nebraska faces off against the Michigan Wolverines this weekend with a 2:30 PM kickoff on CBS, viewable on Paramount+.

A win this weekend would snap a 9-year, 27-straight loss drought against AP top 25 teams for the Huskers. Currently, Michigan is favored by 1.5 points.

The Huskers will also be honoring the 1995 national championship team during the game. Quarterback Tommie Frazier led the way to a perfect 12-0 season and back-to-back championships during the 1995 season, with many considering the ’95 Huskers to be the greatest football team ever.

Quote of the Week:

“I’m very grateful to be at a place that can honor former teams… You know if it’s been done, it can be done.” – Matt Rhule